The Initial Public Offer (IPO) of Access Bank Ghana shares is set to buoy trading activities on the Ghana Stock Exchange, beginning this November.

Listing on stock exchanges is not new to the bank as the shares of its parent company, Access Bank Plc of Nigeria, listed on the Nigeria Stock Exchange, have seen creditable performance over the last decade. Access Bank Plc is ranked among the top three banks in Africa’s second largest economy, Nigeria.

The first factor

Access Bank Ghana has, therefore, become the first bank in five years to list on the Ghana Stock Exchange, a bourse which has not seen any major listing in several years. It is also the first Nigerian company and/or bank to list on the Ghana Stock Exchange, after operating in the country for only seven years. It, therefore, requires the support of the public to make the offer successful.

IPO to help deepen capital market

The 26 million shares on offer for GH¢4 per share between October 19 and November 11, answers calls by some economists, captains of industry and the Securities and Exchange Commission for foreign direct investors and multinational companies to list on the capital market to share their success stories with the Ghanaian public which supported them.

They also believe such moves would contribute to reducing the pressure on the local currency as it waters down the need to transfer all profits made locally offshore to their principals.

The Managing Director of Access Bank Ghana Ltd, Mr Dolapo Ogundimu, said during the launch of the IPO, that the action provided evidence of the bank’s belief in the potential of the Ghanaian economy.

He said the bank was also giving a rare opportunity to Ghanaians and other investors to have a stake in the growing fortunes of the bank.

The current offer allows investors to buy a minimum of 100 shares and the expected proceeds of GH¢104 million would be directed to branch expansion, invest in channels infrastructure; upgrade the technology platform of the bank; replace obsolete infrastructure, as well as retain some as working capital.

Superior numbers

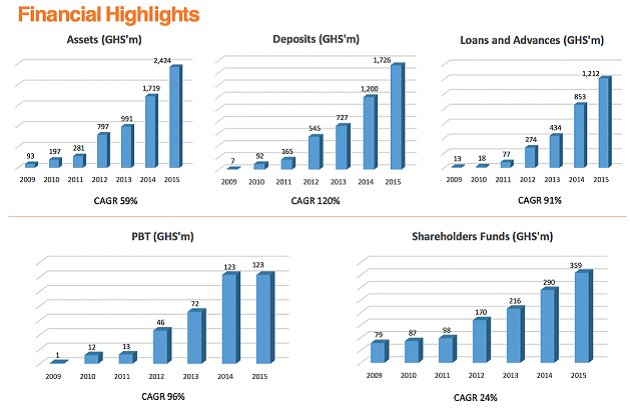

Access Bank Ghana is stepping onto the stock exchange with superior numbers which should interest investors. The net earnings (profit after tax) of the bank has risen steadily over the last six years; from GH¢8.47 million in 2011 to GH¢80.44 million in 2015.

Until somewhere around the last quarter of last year, the Financial Stock Index, made up of financial institutions, particularly banks, had sustained the tempo of the exchange which had once gone down in history as the best market in terms of return on investment. The addition of Access Bank to the FSI would obviously rekindle the glow.

According to market analysts, Mr Lawrence Adu Asamoah and Ms Ellen Abena Addo, the bank’s positive growth trajectory of the bank has been underpinned by its commitment to drive profitable and sustainable growth supported by significant investments in key areas of its business to offer superior banking services and products to its customers.

Premium offer

Based on price earnings (P/E) ratio, which values the company by the cost of its shares against the earnings associated with every share held, the IGS Financial Services analysts concluded that the offer price of GH¢4 per share is at a premium to the investor. “This is because at the price of GH¢4, the P/E of Access Bank stands at 5.6 times as compared to P/E of 4.47 times of the eight listed banks as of November 1, 2016.”

On the other hand, they said, comparing Access Bank’s price-to-book ratio of 1.1 times to the prevailing industry average of 1.5 times, the offer price could be selling at a discount. “Thus, with emphasis on the price-to-book valuation, we believe that the offer price of GH¢4.00 is fair.”

Outlook

Going forward, analysts Mr Asamoah and Ms Addo expect a positive outlook for the bank with its revenue lines shifting from the main focus institutional banking, which contributed close to 50 per cent of the bank’s revenue, to currently splitting among its four business segments (Commercial banking, Investment banking, Business banking and Personal banking, with specialised subsets such as oil and gas, private and women banking).