Banks strive to enhance deposit base — Five banks top chart

TOTAL deposits in Ghana’s banking industry amounted to GH¢201.73 billion last year, a significant increase from the GH¢163.70 billion recorded in the same period of 2022.

The significant growth underscores the competitive landscape and continuous efforts of banks to enhance their deposit bases.

Major banks such as Ecobank Ghana (EBG), GCB Bank (GCB) and Stanbic Bank Ghana (SBG) continued to lead the market, while players such as First Atlantic Bank Limited (FABL) and Guaranty Trust Bank (GTB) made notable strides according to the 2023 PwC Ghana Banking Survey report.

It said the industry’s objective of lowering the cost of funds and depositor demands for liquidity was highlighted by current accounts’ dominance in the deposit mix.

For instance, the report noted that savings accounts also played crucial roles in the market deposit mix and increased marginally in 2023, while time and fixed deposits declined.

The phenomenon, the report observed, suggests that Ghanaians may be less willing to lock their money into long-term deposits due to economic uncertainties.

DDEP impact

The report said with an economy reeling from the effect of the DDEP, the continuous increase in customer deposits levels in the banking sector can be attributable to a number of factors including; less investable options available to the banks; and perhaps some increases in the money supply from the monetary policy authorities.

For instance, the report said the high returns still recorded on government treasury bills and Bank of Ghana’s Open Market Operations (OMO) may also account for the increased level in money supply and hence customer deposits.

Current accounts

Meanwhile, it said; “Current accounts continue to constitute more than half of the banking industry’s total customer deposits with the services, commerce and finance sectors of the economy continuing to account for the largest portions of the loans and advances disbursed by the Ghanaian banking sector.

Market leaders

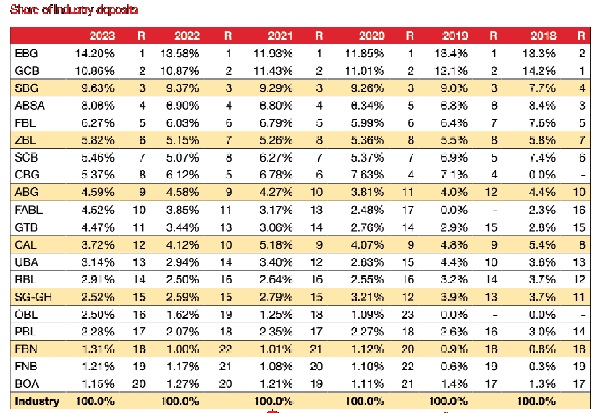

EBG and GCB continue to be the market leaders, growing their combined share marginally from 24.4 per cent in 2022 to 25.1 per cent in 2023.

That, the report said, indicates strong customer trust and robust deposit mobilisation strategies within their combined network of over 250 branches across the country.

SBG and ABSA maintained their 3rd and 4th positions from 2022 while continuing to grow their market share by 1.4 per cent in 2023.

It said although Consolidated Bank Ghana (CBG) continues to improve its share of deposits in the industry, it was overtaken by FBL, Zenith Bank Limited (ZBL) and Standard Chartered Bank (SCB), dropping from its 5th position in 2022 to 8th in 2023.

OmniBSIC Bank Limited (OBL) and FBN, while having smaller market shares, have shown growth, indicating successful strategies in the market.

Top 10

The top 10 banks in total captured over 50 per cent of the total market share with FABL finding its way into the top 10, previously holding the 11th position in 2022 and 13th position in 2021.

The report observed that the shift in depositor preferences towards more liquid assets, combined with the strategic growth of key players, highlights the sector’s adaptability to economic conditions and evolving customer needs.

“As the market continues to evolve, banks that can effectively leverage customer trust and innovate their deposit mobilisation strategies are likely to maintain and enhance their market positions,” the report indicated.

Loans and advances

The total industry share of loans and advances stood at GH₵67.26 billion in 2023, representing a 0.15 percent increase from GH₵67.16 billion in 2022.

The top five banks in the country increased their market share dominance with a combined share of 55.9 per cent.

The commerce and finance and services sectors maintained their dominance among the industry loans taking up 38.9per cent of total industry loans in 2023.

Agriculture, forestry and fishing, however, saw a slight decrease from 3.8per cent to 3.2 per cent.

Mining and quarrying experienced a notable rise from 2.4per cent to 4.1per cent while manufacturing increased from 11.5 per cent to 13.0 per cent, continuing its upward trend.

Loans and advances league table

Between 2022 and 2023, the distribution of industry loans and advances among banks exhibited notable shifts.

For instance, EBG increased its share from 14.7per cent to 16.1per cent, maintaining the top position while GCB saw a significant rise from 9.5per cent to 12.0 per cent, moving from the fourth to the second rank.

ABSA slightly increased its share from 9.8per cent to 10.8 per cent, holding the third rank consistently.

SG-GH improved its shared from 5.2 per cent to 6.8 per cent, while FBL increased its share from 4.7 per cent to 5.5 per cent, moving from the eighth to the sixth rank.

RBL improved from 3.3per cent to 4.1per cent, rising from twelfth to the eighth rank. SCB increased its shares from 3.4per cent to 3.6 per cent.

In contrast, SCB fell from the tenth to the eleventh rank, despite increasing its market share by 0.2 per cent.

Loan allocations

Ghana’s banking sector demonstrated significant adjustments in loan allocations between 2022 and 2023.

Ecobank Ghana (EBG), GCB Bank, and ABSA bank consolidated their leading positions, with GCB showing the most substantial gain in share.

Banks like Republic Bank Limited (RBL) and First Bank Limited (FBL) also improved their standings, while Standard Chartered Bank (SCB) experienced a decline.

Sector-wise, there was notable growth in the mining and quarrying and manufacturing sectors, both in terms of share and absolute loan values.

Commerce and finance, as well as services, saw declines although they maintained the top positions, indicating a shift in loan allocation priorities according to the PWC banking Survey for year 2023.

Share of industry operating assets

The survey report made some key observations on the industry’s operating assets. For instance, it noticed an increase in total industry operating assets by GH₵ 43.1 billion, that is, from GH₵ 187.2 billion in 2022 to GH₵ 230.3 billion in 2023

The major drivers of this increase are liquid assets which increased by 40.5per cent, GH₵ 96.1 billion, as against the 2022 figure of GH₵ 68.4 billion, and cash assets which increased by 30.6per cent, from GH¢ 75.2 billion to the 2022 figure of GH₵57.6 billion.

The report said due to the Domestic Debt Exchange Programme (DDEP), bank portfolio reallocation showed a higher possession of liquid assets, representing 41.7 per cent of industry operating assets as compared to 36.5 per cent in the previous year.

“For the past five years, Ecobank Ghana (EBG) and GCB had the lead as the top banks holding the majority of the banking industry’s operating assets. The story remains unchanged in 2023, with EBG increasing its operating assets by 33.4per cent and SBG by 34.3 per cent. EBG and GCB increased their cash holdings by 74.67 per cent and 26.29 per cent respectively,” the report observed.

It said with Stanbic Bank Ghana (SBG), ABSA and FBL also retained their place in the top five banks having majority share of the industry’s operating assets.

The report also concluded that customer deposits were the main driver of growth in share of industry.