Distressed customers of savings and loans companies in limbo

The fate of thousands of customers of some troubled savings and loans companies hangs in the balance, as the Bank of Ghana (BoG) is uncertain when the GH¢7-billion reforms in that sector will start.

The central bank faces the daunting task of raising more than GH¢7 billion to tackle the crises in the savings and loans industry, as agitated customers whose lifetime savings are locked up in some of the distressed companies are pushing for their money.

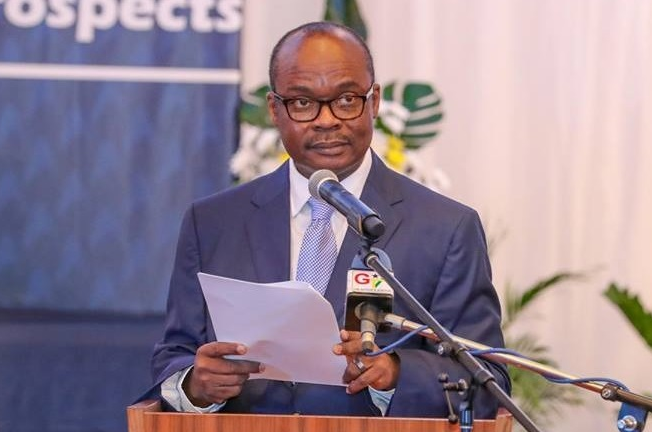

Answering questions posed by the Daily Graphic on when frustrated depositors of troubled savings and loans companies would be bailed out, the Governor of the BoG, Dr Ernest Addison, said it was a huge exercise to undertake and very expensive.

“That is a big exercise, it is very expensive and the magnitude of the cost is very high,” he said.

“We are talking of about GH¢7 billion and I am not sure the government has that budgetary allocation to embark on an exercise of such magnitude,” the governor said.

No money

“We simply don’t have that kind of money now. We simply don’t have the GH¢7 billion to clean up the entire non-bank, deposit-taking institutions and so we are tackling the microfinance sector, for which GH¢900 million has been provided.

“So please give us a little space and we will communicate the fine details of our decisions later,” the governor said when pushed to provide timelines.

The BoG last week revoked the licences of 347 insolvent microfinance companies due to liquidity challenges and appointed Mr Eric Nana Nipah of Pricewaterhouse Coopers (PwC) as Receiver for the specified institutions, in line with Section 123 (2) of Act 930.

The action by the central bank leaves only 137 microfinance companies in good standing from the almost 566 previously licensed.

Costly reforms

A similar exercise with the universal banks, which ended in December last year, cost the country almost GH¢11 billion, and it is feared that plans to replicate that across the entire non-bank financial institutions (NBFIs) will prove costly for the country.

The action of the BoG in the microfinance sector raised the expectation of many frustrated customers of some distressed savings and loans companies that their locked-up funds would be disbursed to them. But the inability of the central bank to secure GH¢7 billion to reform the savings and loans sub-sector appears to have dampened their expectations.

At the moment, many savings and loans companies, including Alpha Capital and First Allied Savings and Loans, are going through liquidity challenges, making it difficult for their customers to retrieve their savings.

A source at the BoG told the Daily Graphic that the latest move by the central bank was to help sanitise the microfinance sub-sector of the financial services industry which has been hit by liquidity challenges.

Sorry state

Some of the savings and loans companies are said to be in a “sorry financial state” as a result of the panic withdrawals that have hit most of them.

The panic withdrawals are largely a spillover effect from the challenges in the banking sector.

The Association of Savings Companies last year petitioned the BoG to support some of their members said to be in financial distress.

The Executive Secretary of the association, Mr Tweneboa Kodua Boakye, explained that the petition to the BoG to support the troubled firms was meant to prevent most of the companies from going down.