GhanaCares programme to spur growth -Africa Economic Outlook report

Ghana’s economic outlook for the year remains positive in spite of the challenges facing the country.

The country’s projected Gross Domestic Product (GDP) growth at 5.3 per cent for the year and 5.1 per cent in 2023, which are both higher than the Africa average of 4.1 per cent.

The growth is expected to be spurred by the Ghana COVID-19 Alleviation and Revitalisation of Enterprises Support (GhanaCares) Programme.

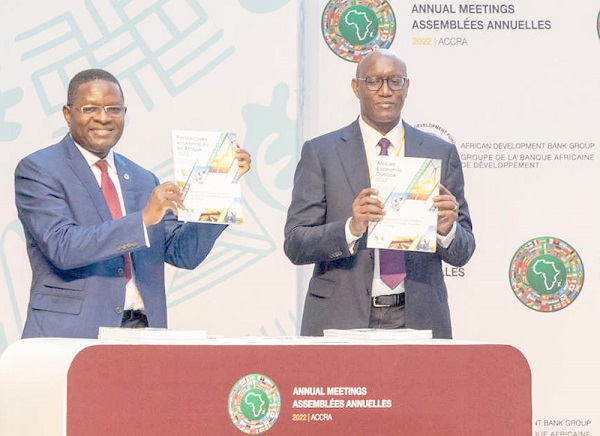

This was contained in the Africa Economic Outlook (AEO) report released in Accra at the close of the African Development Bank (AfDB) meetings last week.

Threat

In spite of the positive projection which is also similar to the earlier ones made by the International Monetary Fund (IMF) and the World Bank during the Spring Meetings, the report noted that potential inflationary pressure existed due to increased energy and food prices associated with the impact of the Russia–Ukraine conflict.

Inflation is projected to surge to 15 per cent in 2022 before falling to 9.1 per cent in 2023.

“The Bank of Ghana is expected to adopt a tight monetary policy stance,” the report predicted.

The fiscal deficit is also projected to narrow further to 12.8 per cent of GDP in 2022 and to 10.3 per cent in 2023, spurred by revenue-enhancing reforms.

The current account deficit is also projected to narrow to 1.6 per cent of GDP in 2022 and 3.3 per cent in 2023, on increased exports.

Africa rising debt

At the continental level the report said Africa’s rising public debt poses a major threat to the economic recovery efforts of the continent.

The report has, therefore, called for a reinstatement and reconfiguration of the Debt Service Suspension Initiative (DSSI).

It is also calling for the need to accelerate governance reforms and strengthen public financial management to deal with the structural challenges of the continent’s rising public debt.

The 2022 AEO report which was launched at the just ended AfDB Annual Meetings in Accra, comes against a backdrop of two major global crises: the lingering COVID-19 pandemic and the Russia–Ukraine conflict.

Presenting highlights of the report, the Acting Chief Economist of the AfDB, Professor Kevin Urama, said the high public debt was also holding back prospects to engender high and sustainable economic growth.

Domestic policy response

He said domestic policy response to the growing public debt remained constrained by limited fiscal space, amid growing social sector spending pressures.

“It is therefore imperative that the global community rethink terminating the DSSI framework, which was designed to provide temporary relief to countries facing growing debt overhang.

“A reconfigured DSSI and Common Framework will limit the impact on Africa’s public debt from the depreciation in domestic currencies due to the global uncertainty stoked by the Russia–Ukraine conflict and spill-over effects of the tight monetary policy stance being implemented in advanced economies,” he stated,

He said African countries need to accelerate governance reforms and improve public financial management in order to decisively address their recurrent debt vulnerabilities.

These actions, he said required building strong budget institutions to efficiently mobilize domestic resources, conduct sound public expenditure, and implement rigorous debt management and budgeting.

“Strengthening the nexus among debt, growth, and governance will help maximise growth dividends of debt-financed public investments.

“Finally, countries need to improve their debt transparency by upgrading their debt statistics overall, particularly on state-owned enterprises’ debt,” he noted.

International efforts

The President of the AfDB, Dr Akinwumi Adesina, for his part, said international efforts, including those of the AfDB Group, the G20 Common Framework for Debt Treatment, and the US$650 billion in Special Drawing Rights issued by the International Monetary Fund were supporting the continent’s recovery.

He said the recovery would, however, be costly, given that the continent would need at least US$432 billion to address the effects of COVID-19 on its economies and on the lives of its people.

Prof Umara said these were resources the continent currently did not have.

He cautioned that the continent risked sliding into ‘stagflation’ which is a combination of slow growth and high inflation.

“Real GDP is projected to grow by 4.1 per cent in 2022, markedly lower than the near seven per cent in 2021.

“The deceleration in growth highlights the severity of the impact of the Russia–Ukraine conflict on Africa’s economy. This growth will be driven largely by private consumption and investment on the demand side and by continued expansion in the services sector on the supply side,” he stated.