BoG report reveals mixed labour market activity

A Bank of Ghana (BoG) report for the first half of the year has revealed mixed labour market activity.

While social security contributions for the Tier One pension scheme and the Composite Index of Economic Activity (CIEA ), witnessed improved growth, that of advertised jobs and consumer confidence index witnessed a marginal decline.

Private sector pensions

Private sector pension contributions to the Tier One pension scheme run by the Social Security and National Insurance Trust (SSNIT), rose rapidly, indicating strong acceptance of the scheme as one of the safest ways to guarantee a better future.

According to the Monetary Policy Report undertaken by the Research Department of the BoG for the first half of the year, indicated that total number of private sector SSNIT contributors, which partially gauges employment conditions, improved by 2.7% to 1,007,341 in May 2024.

That compares with the 980,808 for the same period in 2023.

Cumulatively, for the first five months of 2024, the total number of private sector contributors increased by 4.8% to 5,063,676, from 4,829,487 recorded over the corresponding period in 2023.

Advertised jobs

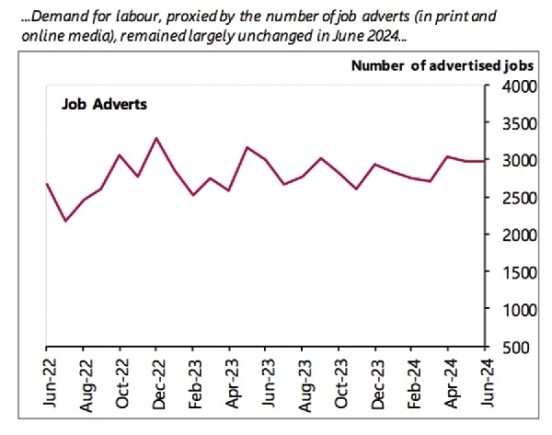

Using the Daily Graphic, the country’s biggest selling and most widely circulated newspaper in the country as its reference, the BoG also observed that “the number of jobs advertised in selected print1 and online2 media, which partially gauges labour demand in the economy, remained largely unchanged in June 2024 relative to what was observed in the corresponding period a year ago.”

In total, 2,968 job adverts were recorded as compared with 2,993 for the same period in 2023. Cumulatively, for the first half of 2024, the total number of advertised jobs went up by 2.4% to 17,278, from 16,866 recorded during the same period in 2023.

Composite Index of Economic Activity (CIEA)

The bank’s updated real Composite Index of Economic Activity (CIEA) recorded an annual growth of 3.3% in May 2024, compared to a contraction of 3.7% observed for the same period in 2023.

The report identified the key growth drivers of the index over the period to be SSNIT contributions from the private sector, imports, port activity, cement sales, exports, passenger arrivals and domestic VAT.

Consumer and business surveys

With regards to consumer and business surveys, the bank found out that, the latest confidence surveys conducted in June 2024 indicated some softening of consumer and business sentiments.

The Consumer Confidence Index declined to 81.2 in June 2024, from 87.7 in April 2024, on account of high food prices and some uncertainties about future economic conditions.

Similarly, it observed that the Business Confidence Index dipped to 88.8 from 92.6 in the same comparative period as businesses expressed concern about the cost implications of the rapid exchange rate depreciation observed in May 2024.

These findings were broadly in line with observed trends in Ghana’s Purchasing Managers’ Index (PMI), which fell below the 50.0 benchmark to 49.7 in June 2024, from 51.6 in the previous month.