Innovate to survive – Bank of Ghana urges banks

The First Deputy Governor of the Bank of Ghana, Mr Millison Narh, has charged financial institutions to continually re-engineer their operations in order to stay relevant in a competitive environment.

The First Deputy Governor of the Bank of Ghana, Mr Millison Narh, has charged financial institutions to continually re-engineer their operations in order to stay relevant in a competitive environment.

He said the stiff competition in the financial services sector meant that institutions which must survive should introduce innovative strategies and products to attract, delight and retain customers.

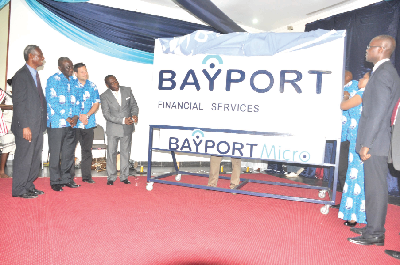

Mr Narh was speaking at the re-branding of Bayport Financial Services Limited and the launch of a new division of the company, the Bayport Micro Division.

The twin event saw the unveiling of a new corporate logo and colours of the company.

The deputy governor also advised financial institutions not to throw risk management to the dogs as they would increase their appetite for risk in response to pressures from the market, saying “the temptation to shift to relaxed financial and operational prudence behaviour has the potential to sow the seed for the demise of an institution.”

Mr Narh commended the company for re-launching itself as a way to “re-present the institution to existing and potential clients and ultimately bring your services to the door steps of your esteemed customers.”

He noted that Bayport Financial Services achieved a significant milestone, growing significantly in a decade, and added that the company was one of the well-capitalised institutions with paid-up capital of GH¢10 million.

The deputy governor was also delighted about the company’s decision to venture into micro finance with the birth of Bayport Micro Division, which he said, would offer clients in the informal sector, varied products to help them expand their businesses and the economy as a whole.

He, therefore, advised management to assess the overall risk profile of the company, especially as it expanded into new operational areas, that would prevent malfeasance, avoid lowering of standards for doing business, and promote good corporate governance.

A deputy minister of Finance, Nana Ato Forson, for his part, affirmed the vast contribution financial institutions had made to the economic development of the country, especially in education, health, agricultural and the informal sector.

He said recognising the high percentage of the informal sector much was expected to be done to support the sector as the economy grew from a lower middle income to the higher brackets of middle income status.

It was in that regard that the government was urging banks and non-bank financial institutions to partner other credit providers to pay more attention to the informal sector and make credit more affordable and accessible to that segment of the economy.

The Chief Executive Officer of Bayport Financial Services, Mr Kofi Adu-Mensah, commended the board, management, stakeholders and staff of the company for their sterling support and sacrifices towards transforming the company from the level of payroll-backed lending to the provision of credit facilities to the informal sector of the economy.

By Samuel Tei Adano/Daily Graphic/Ghana