Reflections, E-levy

Parliament is scheduled to resume sitting on January 25, 2022 and there is eager anticipation that the House will settle once and for all the issue of approval or otherwise of the E-levy bill.

The E-levy has produced so much rancorous heat without light, leaving the population anxiously groping in the dark as to why deliberations on a component of an annual national budget should turn the Chamber of the House into a boxing arena, at the expense of dialogue and consensus building.

Revenue shortfalls

It’s trite knowledge that taxes constitute a major source of revenue for national development and payment is undeniably an important civic social responsibility.

Unfortunately, paying taxes appears not to be a favourite subject among citizens in both the formal and informal sector.

In a country where about 30 per cent of the working population pay income and indirect taxes, and 70 per cent pay indirect taxes only, revenue mobilisation has suffered serious shortfalls over the years, compelling governments to resort to borrowing from both local and foreign sources to fill in the financial gaps.

In effect, deficit financing has been the norm rather than the exception as reflected in the majority of the national budget and economic policy statements presented to the nation in much of the post independence era.

The country’s quest for economic independence has almost become a pipedream in spite of the many God-given natural resources at our disposal.

Surely, we must literally lace our boots, dirty our hands and face our economic problems squarely instead of sticking to our chronic dependence on foreign handouts.

Tax net

Taking our destiny into our own hands entails sacrifices from all, the burden must be shared by all and not the few overburdened taxpayers.

Spreading the tax net implies the adoption and implementation of efficient innovative policies for improving tax revenue inflows particularly from the informal sector.

It is sad to note, for example, that Value Added Tax (VAT) inflows between 2020 and 2021 dropped by 80 per cent, a significant loss of revenue to the national kitty.

Whether this steep decline is attributable to the increasing online business transactions necessitated by the COVID-19 scourge or to deliberate tax evasion strategies, the nation has been the poorer for it.

Resistance to taxes

Our resistance to the introduction of new taxes is legendary. From the days of the introduction of VAT by President Rawlings in 1995, President Kufuor’s “ talk tax” in 2005, to what have been described as “nuisance taxes” in President Mahama’s era in 2014, Ghanaians have greeted new taxes with fears and scepticism about the feasibility or otherwise of placing extra tax burden on citizens.

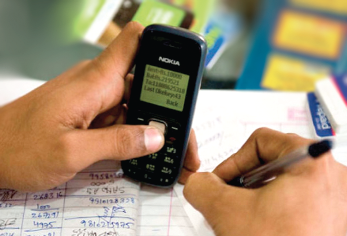

It is interesting to note that the same negative sentiments that greeted President Kuffuor’s talk tax are currently being re-echoed in connection with the E-levy, apparently in defence or protection of the poor, less privileged in society.

Contrary to the dissenting views expressed at the time, the talk tax produced a phenomenal increase in the number of mobile phone users and the upward trend continued even when late President Attah-Mills increased the rate by 50 per cent in 2009.

It is also instructive to recall that in President Mahama’s defence of the imposition of the “nuisance taxes” in 2014, which saw new taxes on condoms, machete, sanitary pads, etc., he described them as necessary evils and not punitive, in view of the paucity of income tax payers in the formal sector, the large population in the informal sector who only paid indirect taxes which were woefully inadequate, and the need to stem the borrowing spree from foreign creditors.

2022 Budget

So why has the 2022 Budget generated such hue and cry over the E-levy? Is it out of fashion to raise funds locally in order to reduce the borrowing syndrome?

Will MoMo users, for example, suffer serious disadvantages with the introduction of the 1.75 per cent levy?

Why the strident calls for zero tolerance of the E-levy? What are the alternatives?

Fortunately, the parliamentary subcommittee on finance has provided answers to these and many queries in its final report to the House.

It remains to be seen what the outcome of the debate on the document will be.

This time round, Ghanaians expect proceedings to be conducted in a realistic, objective, nationalistic spirit devoid of parochial party political interests.

No more fisticuffs or violent confrontations among honourable members on the floor of the House please !

Positive outlook

It is hoped the resistance to the E-levy bill would not impoverish the purposes for which it is being introduced.

Jobs for the teeming unemployed youth, good roads, education and health infrastructure and many socio-economic benefits have been proposed to be financed through the tax.

Citizens have to be vigilant and make the government faithfully account for the utilisation of the revenue that will accrue for the implementation of these projects.

As citizens, our thoughts, utterances and deeds must be with positive confessions, that whatever inures to the general good can and must be pursued to their desired conclusion, so help us God.

The writer is a Retired Educationist

E-mail: