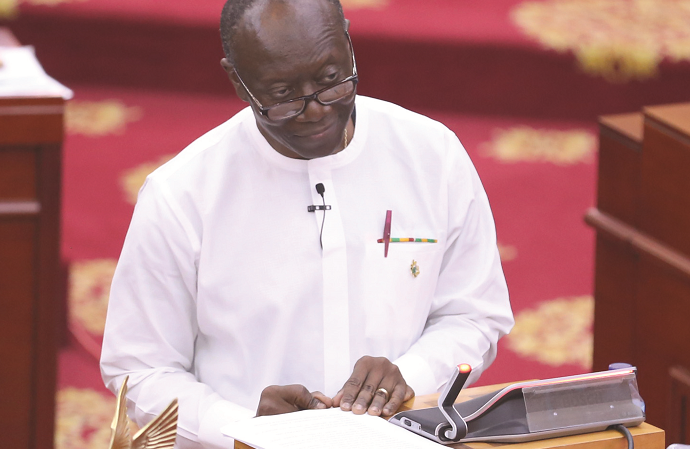

The Minister of Finance, Mr Ken Ofori-Atta, says the introduction of the three per cent value added tax (VAT) flat rate by the government will eliminate the potential evasion of taxes in the country and ensure fairness in the tax collection regime.

He said the new tax did not breach any law and was meant to further enhance the country’s tax system.

Speaking to journalists in Accra yesterday, after a meeting with the Finance Committee of Parliament and some trade associations, Mr Ofori-Atta said the former arrangement with the 17.5 per cent posed difficulty on how to calculate input and output taxes and determine the charges to be paid by importers, wholesalers and retailers.

He said the three per cent tax became part of the production cost and indicated that companies could deduct the cost when computing their taxes.

The meeting was attended by representatives of the Association of Ghana Industries (AGI), the Ghana Union of Traders Association (GUTA) and the Food and Beverages Association of Ghana (FABAG).

Mr Ofori-Atta denied the suggestion that the introduction of the three per cent tax would lead to increase in the price of goods.

He said he held a meeting with the AGI and the indication was that the prices of goods would not shoot up.

Mr Ofori-Atta said the government would continue to meet with the trade associations to reach a consensus on the matter.

Minority criticises govt over tax

Meanwhile, the Minority in Parliament had said the introduction of the three per cent VAT flat rate was illegal since it was against the VAT Act, 2013.

The Ranking Member on the Finance Committee and Minority Spokesperson on Finance, Mr Cassiel Ato Baah Forson, said the introduction of the three per cent VAT flat rate was illegal.

He accused the government of introducing the three per cent tax through the back door since it had not received any parliamentary approval.

Mr Forson rejected the claim by the government that the 17.5 per cent VAT had been withdrawn and replaced with the three per cent VAT flat rate.

He said the introduction of the three per cent VAT flat rate would automatically lead to increases in the prices of goods on the market and asked the government to withdraw the new tax.

He expressed the intention of the Minority to go to court to compel the government to withdraw the tax.

The Member of Parliament (MP) for Bolga Central and member of the Finance Committee, Mr Isaac Adongo, said with the introduction of the three per cent VAT flat rate, wholesalers and retailers would pay close to 27 per cent, as the taxes would move through all the distribution channels.

"The implication is that you would have to pay close to 27 per cent as taxes," he said.

Mr Adongo accused the government of unparalleled incompetence by indicating that it wanted to squeeze Ghanaians to raise taxes and while at the same time creating the impression that it was reducing taxes.

Disagreements among trade associations

The trade associations had differing perspectives about the implication of the introduction of the three per cent VAT flat rate.

While the GUTA was in support of the new tax, the FABAG had a contrary position.

The representatives of the AGI did not speak to journalists concerning their position on the new tax.

The President of GUTA, Barima Dr Ofori Ameyaw, said the association supported the introduction of the three per cent consumption tax because the association had fought for its introduction for the past 10 years.

He said the introduction of the three per cent tax would ensure across the board spread of the tax net "so that there won't be any seeming confusion."

He said the introduction of the three per cent tax would rather lead to the reduction of prices of goods.

The General Secretary of FABAG, Mr Samuel Ato Aggrey, rejected the claim by the government that the 17.5 per cent VAT had been withdrawn and replaced with the three per cent.

He said the 17.5 per cent VAT remained intact and the three per cent was also added to it.

Mr Aggrey said the implication was that the prices of goods would shoot up as the wholesalers and retailers would pass on the additional cost to consumers.

VAT flat rate

The three per cent VAT flat rate is an amendment of the Value Added Tax Act, 2013 (Act 870).

It is a VAT collection and accounting mechanism under which a registered taxpayer who is a retailer or wholesaler of goods applies a marginal VAT& NHIL of three per cent on the value of taxable goods supplied.

The marginal rate of three per cent represents the net VAT payable, and is the difference between the output tax and the input tax of a wholesaler /retailer if the taxpayer were operating the standard rate scheme.