Bayport gets a new Board Chairman

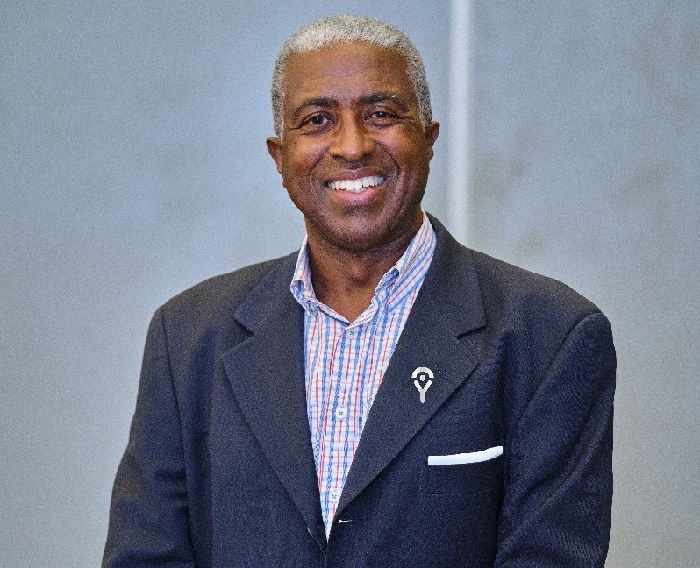

The Bayport Savings and Loans Ltd has appointed Mr Francis Wood, an investment banking professional, as the Board Chairman of the company.

He is to be supported by Sandro Rtveladze (Non-Executive Director), Nii Amankra Tetteh (Executive Director-Managing Director), David K. T. Adomakoh (Non-Executive Director) and Bryan Arlow (Non-Executive Director) as board members.

The company recently restructured its board that saw three board members retire and replaced with new members to oversee the business’ transformational agenda.

With a full approval from the Bank of Ghana, Francis Wood took over as substantive chairman from Kwame Pianim in September 2019.

In an interview, Mr Wood pledged to build a strong management team to help the company to stay afloat in spite of the challenges facing the financial sector in general.

He added that although Bayport has a strong foundation in its board and continues to have a strong management and executive team, he would continue to work to harmonise the board, management and executive teams.

“The leadership structure at Bayport in Ghana is very strong. I think a combination of those things have helped safeguard us,” he pointed out.

Mr Wood said the company was still vibrant on the market irrespective of the banking crisis in the country because the company stuck to its core competence of payroll lending, astute corporate governance structures, and utilising technology efficientlyas well as improving “our engagement with customers.”

Confidence

He explained that considering the banking sector crisis which had impacted negatively on customer confidence, there was the need for all stakeholders in the industry to work together in building confidence in the industry.

“Every player in the banking and finance sector must contribute its quota, with significant leadership from the Central Bank, in rebuilding and regaining the trust and confidence of customers and the economy at large.”

“Every economy, marketplace or industry is different from country to country and it is only players who have been in that space who have the most expertise, experience and are market savvy. To me, taking all theory into account, I think these players ought to be coming together perhaps more frequently and exchanging concrete and specific ideas that can be made public and come out in some kind of paper or document that go into the banking regulation cycle.

That is one way that the customer or marketplace will begin to see that the powers, authorities and players are taking this issue of building trust and confidence very seriously when it comes to the banking and finance sector,” Mr Wood said.

He believes that everybody’s contribution was critical, pointing out that “We are all players in the system including providers of services of products, consumers, agents and lawyers and so I will say that understanding psychology, mindset of customers in the sector and improving communication flow amongst players in the system is crucial because each of the players in the system have different psychologies as a function of their specific space.”