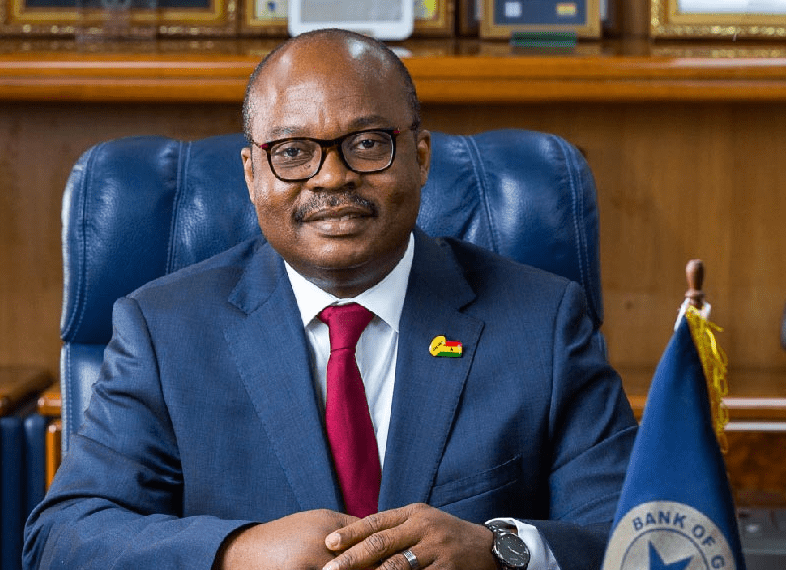

Bulgy deficit, Governor Addison’s biggest nightmare

What keeps the Bank of Ghana Governor, Dr Ernest Addison, awake at night at a time when the raging novel Coronavirus (COVID-19) pandemic is threatening lives and has put the global economy on edge?

It is his fear that a bulgy budget deficit would resurface and be unsustainable in the short to medium-term.

After three years of a painful fiscal consolidation exercise that brought the deficit down from 6.5 per cent in 2016 to 4.8 per cent in 2019; returned inflation to the central bank’s target band; eased the rate of debt buildup among others, Dr Addison now fears that the COVID-19 and its monstrous implications would roll back the gains and return the economy to a state of macroeconomic instability.

When he took his turn on the Graphic Talks360, he told the Graphic Business Editor, Mr Theophilus Yartey, that his biggest headache amid the COVID-19 pandemic, which he described as the biggest shock post-The Great Depression of the 1930s, was that the budget deficit would overshoot its target to a level that would be injurious to the economy.

“I am worried about the budget deficit and I am worried about a budget deficit that might not be sustainable in the medium-term,” the Governor said when asked what kept him awake at the moment.

Challenging time

Dr Addison added that being the Governor of a central bank at a time when a viral disease was wreaking havoc on lives and businesses was “challenging.”

He said the situation was even more hurting in Ghana given that the disease was threatening the fruits of a three-year toil that had succeeded in stabilising the economy.

“Three years ago, in 2017, the Ghanaian economy was growing at a very slow rate, almost three per cent; inflation was high around 25 per cent; the exchange rate was unstable because we did not have a lot of reserves,” he said.

He added that after three years’ hard work, these roughages had been smoothen, resulting in a sustainable deficit, low inflation, higher reserves, strong growth rates and a stable currency.

“Now, we are seeing a development which could derail all the progress that we have made,” he said, referring to the pandemic, which the World Bank and the International Monetary Fund (IMF) said it risked pushing the global economy into negative growth.

Context

Dr Addison’s agitation over an unsustainable deficit is anchored on the gloom that the emergence of the COVID-19 has unleashed on the local economy and the damage that high budget deficits have imposed on fiscal and monetary operations in recent times.

Earlier, the bank had projected that the pandemic would lead to GDP growth slumping from a target of 6.8 per cent to 1.7 per cent in 2020 on the back of depressed business operations and consumption.

A preliminary assessment by the Ministry of Finance in May showed that the pandemic could create a fiscal gap of about GH¢21.42 billion, comprising a revenue shortfall of GH¢15.85 billion and COVID-19-related expenses of GH¢5.57 billion).

The ministry said although funds sourced from the Ghana Stabilisation Fund, the IMF and the World Bank had been helpful, a deficit of GH¢17.9 billion still existed and now had to be sourced from domestic and external sources.

Deficit situation

In its Fiscal Development Report published in May, the bank gave a glimpse of the havoc that the pandemic had started wrecking on the economy.

The report revealed that revenue mobilisation and public expenditures suffered their worst outturns in five years in the first quarter of this year.

While total revenue and grants were uncharacteristically below target, public spending had overshot the budget target by more than a quarter – amplifying the pressures that unbudgeted expenses to contain the COVID-19 spread and its ripple effects were having on the public purse.

Consequently, the deficit almost doubled its target to 3.4 per cent of Gross Domestic Product (GDP), while the primary balance registered a negative 1.7 per cent of GDP in the first quarter – more than eight times above the target of 0.2 per cent of GDP.

Following from these, the BoG report noted that “the expanding deficit and the primary deficit would exert pressure on the public debt stock, and alongside lower growth projections for 2020, may pose debt sustainability risks over the medium-term.”

Measures

Conscious of these implications, the BoG Governor said both the fiscal and the monetary authorities needed “to do some work.”

He said revenue mobilisation from domestic sources needed to be stepped up to help make up for the strong growth in expenditures and close the widening deficit.

He said the country should not allow the pandemic to “undermine the gains that we have made over the past three years.”

On his impressions with the fiscal policy response so far, Dr Addison said he was satisfied with it except that the country needed to be forward looking by anticipating the impact of current developments on the economy in 2021 and 2022.

Already,the BoG has resumed lending to the government through an asset purchase programme that has seen it make available GH¢5 billion to the Ministry of Finance with plans to advance the same amount should the need arise.