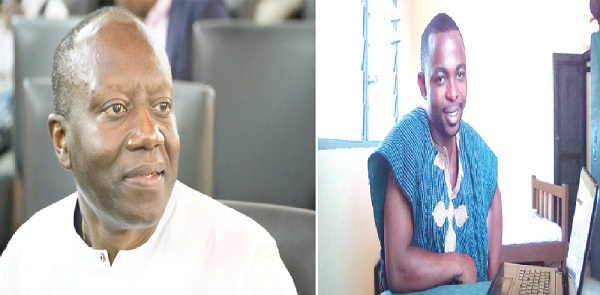

An economic analyst with Data Bank Financial Services, Mr Courage Boti, has said the midyear revisions in the 2017 budget are positive and good to boost investor confidence in the economy.

He said the government’s decision to maintain most of the macroeconomic targets was a step in the right direction and should be applauded because what investors would always look at are the macroeconomic targets and not revenue generation.

In an interview with the GRAPHIC BUSINESS, he said “Investors are not interested in how much revenue you are able to raise, they are interested in inflation, interest rates, the stability of the your currency and how they can get higher returns on their investments.”

“We should ,therefore, commend the government for keeping the inflation target intact, the GDP growth intact and even reducing the fiscal deficit despite the shortfalls in revenue,” he stated.

He said the government’s decision to cut down on expenditure to make up for the revenue losses was ,therefore, necessary because it was going to prevent the situation of the government having to look at external sources to fund its expenditure.

Despite most of the government’s major programmes beginning in the second half of the year, Mr Boti was confident the government could still stay within its expenditure target if it ensures proper fiscal discipline.

“Most of their programmes are starting in the second half of the year but I think they can still stay within the expenditure target because the cuts didn’t affect any of their major programmers like. The cuts were on goods and services, statutory funds and capital expenditure,” he noted.

Revised macroeconomic targets

The overall GDP growth rate was maintained at 6.3 per cent, however, the nominal GDP was revised slightly from GH¢ 203.41 billion to GH¢ 202.01 billion.

The non-oil GDP growth was also maintained at 4.6 per cent, whiles end-year inflation was also maintained at 11.2 per cent.

The overall fiscal deficit was also revised downwards from 6.5 per cent of GDP to 6.3 per cent, with the primary balance also revised from 0.4 per cent of GDP to 0.2 per cent.

Gross foreign asset is also projected to cover at least three months of imports of goods and services same as originally projected.

{loadmodule mod_banners,Nativead1}

Govt commitment to fiscal discipline

The Minister of Finance, Mr Ken Ofori Atta, also in an interview with the GRAPHIC BUSINESS after presenting the midyear budget review said the government was very confident in meeting all of its targets in the budget.

“We said we will grow the economy at 6.3 per cent, currently we are at about 6.6 per cent, we said inflation will be 11.2 per cent by end of year, we currently at 12.1 per cent. This shows that we are on the right track,” he stated.

“We feel very comfortable about the targets. What we need to do now is to be more vigilant about our revenue measures,” he added.

He said the government had put in certain enforcement measures and was ,therefore, expecting revenues to pick up.

Mr Ofori Atta also pointed out that the government was committed to ensuring fiscal discipline in the running of the economy.

“The key issue for all of us here is we are beginning a new dialogue of spending within the limit of what we have. We are committed to spend within our means and that’s the defining difference now,” he mentioned.

Revenue shortfall

The government recorded a revenue deficit of GH¢ 3billion in the first six months of the year as total revenue for the period amounted to GH¢ 17.5 billion against a target of GH¢ 20.5 billion.

Taxes on income and property accounted for 47 per cent of this deficit, while taxes on international trade accounted for about 33 per cent of the total shortfall. The remaining 20 per cent was accounted for by the shortfall in taxes on Domestic Goods and Services.

Grant disbursements from development partners also amounted to GH¢808.4 million and was 20.6 per cent lower than the budget target of GH¢1.0 billion.

The shortfall was attributed to the slow level economic activity in the services sectors of the economy which impacted income taxes, while lower import volumes led to lower revenues from international trade taxes.

Expenditure contained

Expenditures were also largely contained as total expenditure, including payments for the clearance of arrears in the first half amounted to GH¢23 billion against a target of GH¢27.6 billion.

Out of the expenditure, wages and salaries for the period amounted to GH¢6.8 billion which was within the target of GH¢6.9 billion, expenditures on the use of goods and services amounted to GH¢854.6 million against the target of GH¢1.4 billion, while interest payments amounted to GH¢6.7 billion against a target of GH¢7.1 billion.

Capital Expenditure (CAPEX) also amounted to GH¢2.4 billion against a target of GH¢2.9 billion. Foreign-Financed Capital spending was, however, higher than target due mainly to improved project loan disbursements.