Analysis of Interest payment burden and debt sustainability (2017-2021): -A non-technical conversation (Part 1)

All economies under the sun have gone through several phases of the economic cycle from boom to depression or from prosperity to depression.

It does not matter whether we are discussing the economic history of advanced, emerging and developing economies, Sub-Sahara Africa and even Ghana,

The graph reveals that there is time for boom, recession, depression, and recovery. If the economy is experiencing a boom, steps should be taken to sustain it.

If the economy is experiencing a decline, steps should be taken to avoid a recession and depression. Even if recession or depression takes place, efforts should be put in place to ensure recovery.

In presenting this brief analysis, part of the data and graphs have been sourced from the IMF, National Budgets from 2017 to 2022. A five-year analysis is considered to provide easy to observe patterns to be able to question and develop policy measures to address.

This is easy to understand, easy to communicate and create an active memory for the reader with reference to the tables or the graphs. For example, it is easy to ask why the growth for all the sectors declined from 2017 to 2019.

Economic growth projections and recovery

In 2020, the economic growth for the world economy. Advanced economies, and that of emerging markets and developing economies were all negative.

Recovery efforts that were deployed produced significant growth in 2021 with positive growth projections for 2022 as in the World economic growth projection graph above.

The lesson is that in times of depressed financial, economic, and fiscal situation, the focus should be on recovery efforts and strategies and not the defense of the depressed situation to look good. The growth per sector graph below also shows downturn from 2017 to 2020.

The graph shows that from 2017 to 2019, agriculture, industry and services declined except in 2019 that services recovered marginally.

However, in 2020, industry growth was negative (-3.6 per cent) with services just below 1 per cent. In 2021, agriculture and services sectors recovered but industry recorded -o.5 per cent growth with all the three sectors projecting recovery in 2022.

The summary is that all the sectors were experiencing decline before COVID-19 and became worse during the peak of the pandemic.

The period of decline coincided with the implementation of planting for food and jobs and one district one factory policies. This calls for some investigation into the policies and their implementation.

Government’s position on public debt

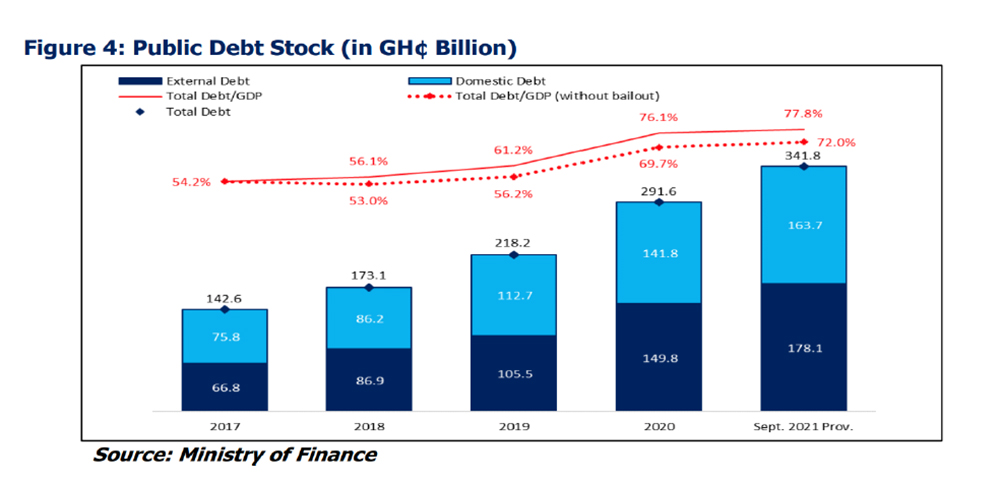

The 2022 budget shows that external debt as a ratio of total debt, increased from 47 per cent in 2017 to 52 per cent in 2021 September. As the cedi depreciated from GHS4.20 to GH¢6.25 over the period, just using conservative figures and non-open market exchange rates, the depreciation contributed hugely to the debt stock of the country.

Between 2017 and 2021 September, external debt in absolute term, increased by 62.5 per cent while domestic debt increased by 53.7 per cent. The debt/GDP ratio increased from 54.2 per cent in 2017 to 77.6 per cent in September 2021, even though, the GDP was rebased in 2019/2020, and if not so the debt/GDP would have been worse.

It is precarious that between 2017 and 2019 the debt/GDP ratio increased by 7 per cent and between 2019 and 2020 the Debt/GDP increased by 14.9 per cent. This shows that COVID-19 pandemic was used as an excuse to borrow excessively.

COVID-19 expenditure audit is required to assure Ghanaians about the use of the COVID-19 funds. This is crucial because the peak of the pandemic was in 2020, an election year where the use of money for election related inducement was observable throughout the country. Another reason is that the IMF also called for such an audit which has not been adhered to yet. Finally, COVID-19 related expenditure audits in some countries have reported unfortunate findings and Ghana should conduct this audit show whether or not procurement rules, the duty of executive accountability, transparency, responsibility and disclosures have been followed.

The threshold for debt sustainability internationally is 60 per cent, implying that the threshold was breached with debt distress indication since 2019.

However, using ECOWAS convergence criteria of less than 70 per cent, the public debt showed indication of distress from 2020.

Ghana’s worse income distribution

Using the Lorenz curve to show whether income distribution among the population is equitable, it shows worse income distribution for Ghana. The curve for Ghana is farther away from the line of equity, hence worse.

Population and national income data from the World Bank have been used to construct the Lorenz curve. Even fragile states performed better than Ghana. Job creation efforts are needed to help citizens share in national income.

Transformation of agriculture, skills development with assurance of product and services market and actualising regional economic opportunities are key correct the trend.

The usual debt burden indicator is the debt/GDP. Though it does not reveal all the implications of the level of debt of a country, it is an important indicator that communicates possible distress. The structure of the GDP as to whether, it supports new economic opportunities, robust contribution to revenue efforts and new jobs, will reflect of other indicators.

Thus, quality, and sustained growth is required to manage debt and remain attractive. The indicators are interpreted based on a benchmark as constructed by the IMF for emerging and developing countries. When the international debt sustainability ratio of 60 per cent is used, it means in 2020 and 2021 Ghana’s debt has crossed over to unsustainable level given that other supporting indicators show similar trend within the period.

This should have started from 2019 had it not been for the rebasing of the GDP. However, with the ECOWAS convergence criteria of less than 70 per cent, Ghana’s debt is not sustainable and induced distress.

Since revenue is generated to finance expenditure, we computed debt/total revenue and compared with the benchmark of 250 per cent. The debt/total revenue ratios from 2017 to September 2021 shows unsustainability of Ghana’s debt with 113.04 per cent deterioration in 2017 and 235.82 per cent deterioration in 2021.

It means total revenue could only cover the debt in 2017 if the revenue were to increase by 113.04 per cent and 235.82 per cent in 2021. It also means the borrowing is not guided by revenue levels but other factors not in the fiscal responsibility matrix.

The debt/GDP and debt/total revenue show increasing trend of deterioration debt sustainability from 2017 to 2021.The debt sustainability of a country also depends on revenue from exports.

Thus, we computed the debt/export with a benchmark of 150 per cent. However, the ratios show incapability to cover the debt each year from 2017 to 2021. In 2017, more than 77 per cent of export was needed to cover the country’s debt and 255 per cent more export revenue in 2021.

It also revealed the need to strengthen export drive through value addition and diversification of export destinations. Revenue is such an important element in debt management such that when its role is undermined debt distress is sure to occur.

The writer is the Dean of the Business School at the University of Cape Coast (UCC)