Banks will withstand credit shocks - BoG

THE Bank of Ghana is confident that banks will be able to withstand the credit shocks caused by COVID-19 pandemic.

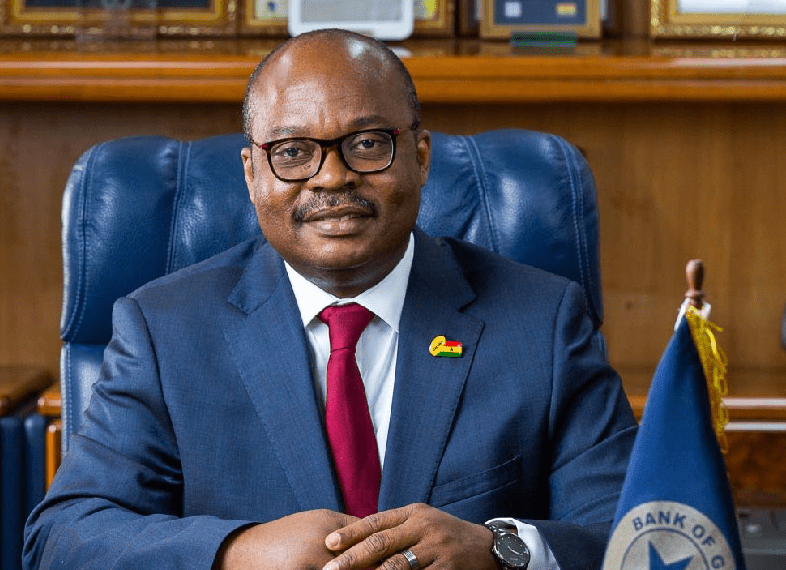

The Governor of the Bank of Ghana (BoG), Dr Ernest Addison, said the latest stress tests by the central bank, which was conducted in April 2020, suggested that banks were strong, resilient and well-positioned to withstand mild to moderate liquidity and credit shocks.

He gave the assurance on the basis of the strong capital buffers and high liquidity positions of the banks, adding “capital adequacy ratio is well above the revised regulatory floor of 11.5 per cent.”

Dr Addison said the industry’s non-performing loan ratio had, however, inched up during the quarter, reflecting the emerging impact of the pandemic on low credit growth and higher loan provisioning.

“So far, banks are also responding positively to the recently announced policy initiatives to support the economy by reducing lending rates and supporting credit growth, as well as offering moratoriums on loan repayments to cushion customers,” he said.

This was contained in the Monetary Policy Report of the BoG.

COVID-19 audit report

Auditing firm, PwC Ghana, in its recent report on COVID-19 and its impact on the banking sector predicted that the pandemic might lead to higher credit losses for the banking sector.

It also said it would impact negatively on overall asset quality, capital and liquidity in the sector.

With the economic slowdown, PwC said there was heightened risk of banks reducing their fees and trading income which would put pressure on their net interest income.

While the uncertainties arising from COVID-19 are substantial and circumstances are sure to change, the firm said it expected that to preclude banks from estimating their expected credit losses (ECLs).

“Estimating ECLs is challenging, but that does not mean it is impossible to estimate an impact based on the reasonable and supportable information that is available,” it added.

Credit risk

The report further said a key element in determining ECL was the assessment of whether or not a significant increase in credit risk had occurred, and hence whether a lifetime, rather than 12-month ECL was required.

“In many cases and in particular in quarter one of 2020, it is unlikely that banks will have sufficient timely data to update loan-level probabilities of default which are often a core element of assessing SICR,” it said.