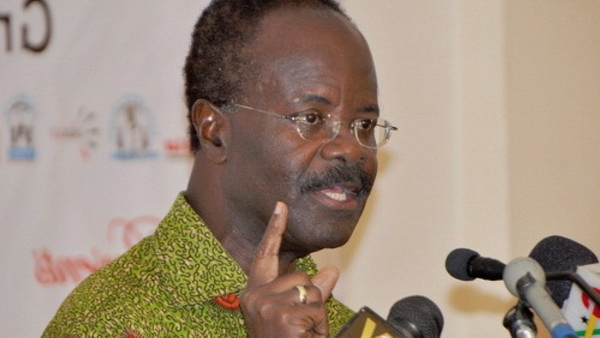

BoG assessment of GN Savings false - Nduom’s lawyers

Lawyers for Dr Papa Kwesi Nduom, the majority shareholder of the defunct GN Savings, have urged the Accra High Court to cancel the revocation of the license of the financial institution by the Bank of Ghana (BoG) on the basis that the BoG failed to properly assess the company’s books.

In a 39-page address to the Human Rights Division of the Accra High Court, lead counsel for Dr Nduom, Mr Justice Srem–Sai, argues that the BoG failed to conduct “a true, fair and independent assessment of GN’s savings books” and that if the Central Bank had done a proper assessment it would have realised that GN Savings was indeed solvent.

“Indeed if the BoG had conducted a proper, fair, true and independent audit into the books of GN Savings, it would have known or come to the obvious conclusion that GN Savings was solvent and, therefore, capable of meeting its debt obligation at the time the BoG revoked its operational license,” the address argued.

Dr Nduom and two entities affiliated to him – the Coconut Grove Beach Resort and Groupe Nduom are in court challenging the revocation of the license of GN Savings by the BoG on August 16, 2019.

“GN was solvent”

On August 16, 2019, the BoG revoked the licenses of GN Savings and 22 other savings and loans, and finance houses which the central bank declared as insolvent.

With regard to GN Savings, the BoG stated that even though GN Savings indicated that the government owes it Gh¢942.98 million of which Gh¢102.73 million represented interim payments certificates (IPCs), the BoG was able to confirm only Gh¢30.33 million as the debt owed by the government to GN Savings.

The BoG, therefore, concluded that even if the outstanding Gh¢30.33 million was taken into consideration, GN Savings still had a capital deficit of Gh¢683.66 million and was therefore still insolvent.

However, Mr Srem-Sai contends in his written address to the High Court that an independent audit conducted on loans advanced by GN Savings and Groupe Ndom to contractors engaged in government projects between October, 2005 and June 30, 2019 put the value at Ghc385, 905,327.81(the amount was without the interest).

Counsel further argues that the core of GN Savings and Groupe Nduom’s assets are investments made in what is known as “Government Infrastructure Project Portfolio” and that the total value of the portfolio was Gh¢2.2 billion.

According to counsel, the BoG had not challenged the independent audit conducted on the books of GN Savings, while it had also failed to take the Gh2.2 billion value of the investment made into government infrastructure projects into consideration.

“Being so, the assets, if duly taken into account in the determination of GN Savings’ capital adequacy ratio (CAR) or solvency, would have led BoG to the unquestionable and unequivocal conclusion not only that GN Savings was not insolvent, but also that it was incredibly solvent,” counsel argued.

BoG application thrown out

Lawyers for Dr Nduom filed the written address on April 8 after the court on March 11, this year ordered both parties to file their written addresses within 18 days.

The order followed the court’s dismissal of a stay of proceedings application filed by the BoG.

The BoG had wanted the High Court to halt the legal action until the final determination of its appeal at the Court of Appeal challenging the jurisdiction of the High Court to hear the case.

It was the contention of the BoG that the case ought to be heard by an arbitration panel, but the High Court dismissed that preliminary legal objection and also dismissed the stay of proceedings application.

Substantive case

The applicants, on August 30, 2019, filed an application at the Human Rights Division of the High Court, challenging the decision of the BoG to collapse GN Savings and Loans Company Limited.

The Coconut Grove Beach Resort and Conference Centre Limited, Groupe Nduom (GN) Limited and Dr Nduom are praying the Human Rights Division of the High Court to make an order of certiorari quashing the August 16, 2019 announcement declaring GN Savings and Loans Company Limited insolvent and consequently revoking its licence to operate as a specialised deposit-taking institution.

The applicants want a declaration that the licence revocation is invalid because the BoG and the Minister of Finance based their decision to revoke the licence of GN Savings and Loans, as a specialised deposit-taking entity, on woeful inaccuracies.

The applicants are also praying the court to hold that by the respondents’ failure to take into account the government’s indebtedness to Groupe Nduom, Gold Coast Advisors and GN Savings and Loans Limited before concluding that GN Savings and Loans was insolvent, the BoG had violated, was violating or was likely to violate the rights of the applicants and GN Savings and Loans to administrative justice, property and equality or non-discrimination.

Writer’s email: