Sahel Sahara merges with Omni Bank and abandons GN, Premium deal

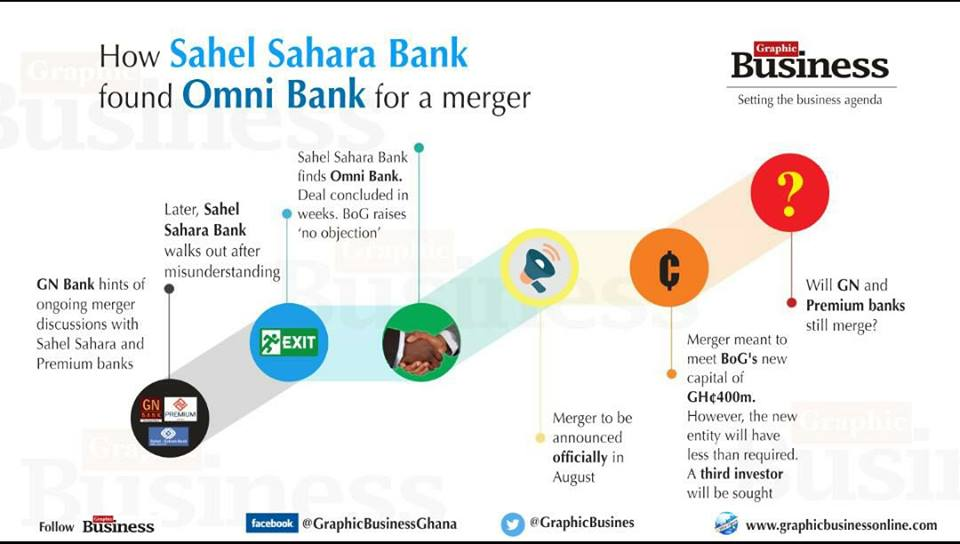

Sahel Sahara Bank and Omni Bank have agreed to consolidate their operations into one entity in a merger deal that could be the first of a few in the banking sector between now and December.

A merger deal between the Omni Bank, a member of the Jospong Group, and the Sahel Sahara Bank, which is owned by 13 Sahelian.

The consolidation of the two banks is to create a stronger bank that can meet the BoG’s new minimum capital demand of GH¢400 million by December this year.

When successfully consummated, the deal could create a larger bank with almost 1,000 employees on its payroll and 46 branches, servicing customers in seven regions nationwide.

Its total assets could also be in excess of GH¢1.3 billion, while stated capital would be around GH¢213 million – still below the central bank’s new minimum capital of GH¢400 million.

While the Omni Bank’s stated capital was reported at GH¢141.6 million, that of the Sahel Sahara Bank closed the year at GH¢71.6 million.

Why approve?

In an interview, a retired Deputy Governor of the BoG,

“Why will two banks merge and still not meet the minimum capital?” he asked in an interview on August 13.

“If they cannot meet, then they must as well go their separate ways because the idea is to make a stronger bank out of the two. But if you are going to merge and still not meet some key requirements, then there is absolutely no justification for a merger,” he said.

However, another source told the paper in confidence that the two sides had agreed to use a third party investor through preference shares to help increase the capital to the required amount before December this year.

The plan for capital restoration was part of the strategies presented to the BoG, the source said.

Opportunity for leverage

An investment banker,

He added that the bank’s footprints in the 12 other Sahelian countries will, however, give the new entity a stronger platform on which to leverage for growth.

Given that Omni Bank is currently strong on funding to SMEs,

New name

The GRAPHIC BUSINESS understands that discussions on a merger between the two banks started in July this year but firmed up towards the end of that month.

Consequently, a presentation on the merger was made to some staff of the Banking Supervision Department in the week ending August 10.

One source said the central bank gave a ‘no objection’ response to the merger presentation.

Although all parties are respecting confidential clauses, the paper further understands that BoG's approval will be communicated to the management of Omni Bank and Sahel Sahara Bank in writing this week.

This will set in motion the actual process of integrating the operations of the two banks into one, ostensibly to meet the BoG’s new minimum capital demand of GH¢400 million by December this year.

Transaction advisors

The deal is being overseen by Bora Advisory Services, an indigenous financial service advisory firm.

It is understood that a new name for the merged entity is still being discussed.

In spite of their differences in ownership, both the Sahel Sahara and Omni banks are relatively small, with their 2017 financial accounts showing that they have virtually the same balance sheets. This makes them a perfect match in a merger deal.

Read also: GN Bank conclude merger talks with Premium and Sahel Sahara banks

Although good news for Omni Bank and Sahel Sahara, the merger deal between the two banks now places the previously anticipated consolidation of the GN, Premium and Sahel Sahara banks in the balance.

When contacted, the Managing Director of GN Bank,

When pressed further on Sahel Sahara’s exit,

In July, GN Bank alerted its staff that a merger deal among it and the two other banks

Although it was successfully submitted to BoG for review and approval, Sahel Sahara later exited into the waiting arms of Omni Bank.

Omni Bank, previously known as Union Savings and Loans, began full banking operations in November 2016 after receiving a

Last year, the bank halved its 2016 net loss of GH¢28.7 million to GH¢14.7 million.

Sahel Sahara Bank, on the other hand, has been operating in the country since March 2008.

It is part of the BSIC Group, headquartered in Sirte, Libya. The group was created in 1999 by 28 countries under the Community of the Sahel Sahara States, also called CEN-SAD.

Although a majority foreign-owned bank, the agreement establishing the bank grants it indigenous status, including exempting it from paying taxes. — GB