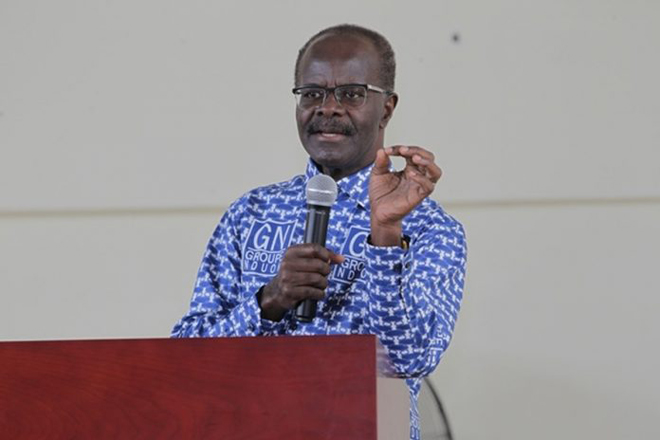

Why you should bank with GN Bank - Nduom explains

President of Groupe Nduom, Dr Papa Kwesi Nduom, is calling on Ghanaians to help grow the economy by banking with the indigenous Bank, GN Bank.

He confirmed that shareholders of GN Bank are making the necessary investment into the bank’s operations in order to help meet the Bank of Ghana’s minimum capital requirement of Gh¢400million.

GN Bank has made strides in the banking sector including being the bank with the largest footprints, having over 300 branches across the country and having one of the lowest non-performing loan portfolios.

Dr Nduom also revealed in his post that GN Bank, a subsidiary of Groupe Nduom, is committed to maximizing technology to render quality services to its customers.

“The Bank is about to invest in a super modern technology

This he believes would contribute to strengthening the financial capacity and operations of the bank.

GN Bank offers the highest interest rate of 9 per cent on regular savings account with a 1,000 Ghana Cedi life insurance cover even if your savings account holds only 5 Ghana Cedis.

Below is a copy of what Dr Nduom posted

BANK WITH GN BANK AND SUPPORT GHANA'S DEVELOPMENT

GN Bank has the most footprint of all the banks in Ghana with 20% of all banking retail outlets - 300 OF THEM - in Nandom, Kwame Danso, Wulensi, Zebilla, Dzemeni, Awaso, Pampram, Asebu, etc in all the ten regions. The Bank has over 10% of the total customers of all banks in

the country.

That is a huge investment that is only beginning to produce positive results. The Bank has one of the lowest non-performing loan portfolios.

The Bank is about to invest in a super modern technology

GN Bank can only get stronger financially and operationally. It is the only Bank in Ghana that offers 9% interest on a regular savings account

plus a 1,000 Ghana Cedi life insurance cover even if your savings account holds only 5 Ghana Cedis.

The shareholders are patient, long-term investors who are in banking to support Ghana's development. They are not in the business for short-term gain.

And they will invest more of their capital in the Bank to reach the GHS400 million minimum capital required by the Bank of Ghana.