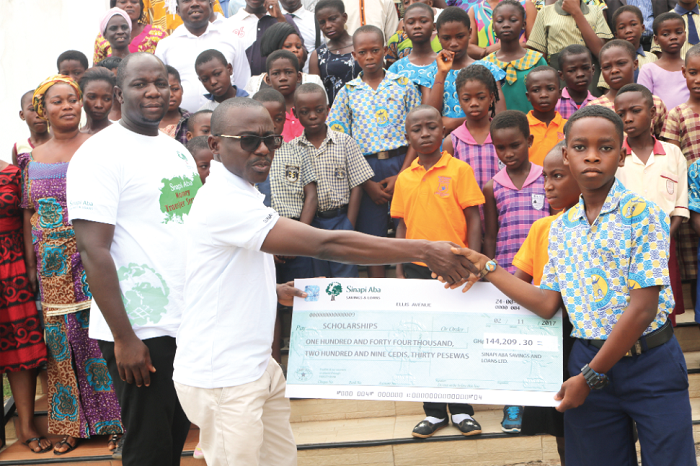

Sinapi Aba Savings & Loans offers scholarship to 218 pupils

Two-hundred and eighteen (218) pupils from 75 selected private schools across the country are to benefit from a scholarship scheme worth GH¢300,000 from Sinapi Aba Savings and Loans, a non-banking financial institution.

The maiden scheme is to support brilliant needy pupils from upper primary to junior high school (JHS) level and it will be for two academic years. Out of the 218 pupils, 125 were selected from the Ashanti Region; 15 from the Greater Accra Region; 24 from the Central Region and three from the Upper East Region.

The Western Region had 24 beneficiaries, while the Brong Ahafo, Eastern and Volta regions had nine pupils each benefiting from the scheme. The selected schools are beneficiaries of the Sinapi Aba micro-school project, a product that provides assistance to private schools to expand and create conducive environments for effective teaching and learning.

The Head of Business of Sinapi Aba Savings and Loans, Mr Vincent Amponsah, who disclosed this at a short ceremony held in Kumasi, explained that the scholarship was instituted for private schools that accessed the Sinapi Aba micro-school product for a two-year period. He said Sinapi Aba Savings and Loans, through its international partners, would continue to create opportunities for the people the company served.

He expressed the hope that the package would be extended after the stipulated two-year period.

Mr Amponsah said the product would give brilliant needy pupils the opportunity to complete their basic education and reduce the financial burden on their parents.

He, however, urged parents to encourage their children to learn hard and continue to maintain their excellent performances as their continuous access to the educational scheme would be based solely on merit.

He added that any beneficiary who could not maintain academic excellence would be withdrawn from the scheme.

Mr Amponsah reiterated Sinapi Aba’s resoluteness in the business of touching lives and creating wealth and used the opportunity to encourage small businesses and other private schools to come on board and experience the best the company had to offer in “growing small businesses into an empire, as well as creating conducive environments for effective teaching and learning.”

![]()

Sinapi Aba Smart Kid Account

According to Mr Amponsah, Sinapi Aba has also introduced a package called the Sinapi Aba Smart Kid Account, a custodial account in the name of a minor or child to be managed by the parents or guardian of the child who may be in school or out of school, between day one till age 18.

He explained that the responsibility of managing the account shall be transferred to the child once the child is 18 years.

“The account allows parents and guardians to invest for the future of their wards and earn profitable interest,” he noted.

Beneficiaries

Mr John Martey Sai, a parent who could not hide his contentment, lauded Sinapi Aba for its benevolence, which he admitted was a “saviour” for parents who never dreamt they could finance their wards to further their education to greater heights.

“I am overwhelmed. If all financial institutions can do this, I think no child of school-going age will be seen hawking on the streets,” he said.

The Proprietor of New Life Christian Academy at Sepe-Dote in Kumasi, Reverend Kofi Sarpong, accompanied three of his pupils who are beneficiaries of the scheme, to the programme.

He praised Sinapi Aba for being a trailblazer in the Ghanaian money-lending business.

Sharing his personal experience with the company, he said he had been doing business with Sinapi Aba for almost five years now, and that he could testify that he had made satisfactory gains from partnering the institution.

He said but for Sinapi Aba, his school would have suffered in the area of infrastructure, adding that through Sinapi Aba, he was able to access flexible loans to expand the school and also buy a bus for the school’s operations.

According to him, all one needed was to be a loyal customer to the institution to benefit from its several relief packages.

He used the opportunity to urge all to pay back their loans as scheduled in order for other people to also benefit.