Debt Overhang: Debt reduction and crowding out - The case of Ghana’s domestic debt crisis, 2022/2023

The study analyses how domestic debt crisis of 2022/2023 has slowed down and restrained economic growth and development in Ghana through the channels of debt overhang, crowding out and debt reduction effects.

The domestic debt crisis has impacted negatively on the economy because of debt overhang, debt reduction and crowding out which arose out of inability of the government revenue is inadequate for debt servicing and that economic stability is undermined by debt burden if debt service cost weighs down public expenditures.

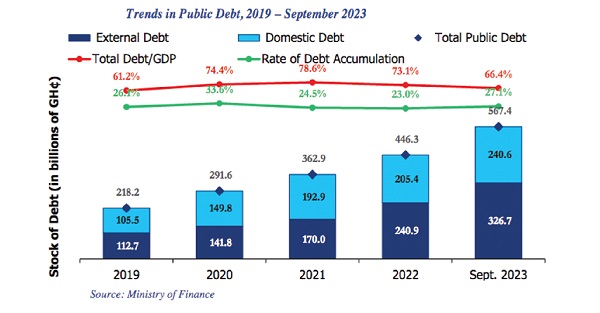

This implies that public investments are crowding out as rising national debt obligations consume a large proportion of government revenue. Ghana’s economy entered a full-blown macroeconomic crisis in 2022 on the back of pre-existing imbalances and external shocks. Large financing needs and tightening financing conditions exacerbated debt sustainability concerns, shutting-off Ghana from the international market.

Large capital outflows combined with monetary policy tightening in advanced economies put significant pressure on the exchange rate, together with monetary financing of the budget deficit, resulting in high inflation. These developments interrupted the post COVID-19 recovery of the economy as GDP growth declined from 5.1% in 2021 to 3.1% in 2022.

World Bank (2022) find that the fiscal deficit widened slightly to 9.3% of GDP in 2021 but further increased to 12.1% of GDP in 2022 due to higher spending. Public debt rose from 79.6% in 2021 to over 88.1% of GDP in 2022, as debt service-to-revenue reached 117.6%. The situation of the public finances was unsustainable, with debt reaching 88.1% of GDP and nearly half of the budgetary resources in 2022 dedicated solely to interest payments.

The present value (PV) of Public and publicly guaranteed (PPG) debt to GDP ratio as at November 2022 stood at 100.34%. The government has set a PV of PPG debt to GDP ratio of 55% by the end of 2028 to achieve debt sustainability. Ghana formally announced its debt restructuring program at the start of December 2022 as a prerequisite to access IMF funding, required of any country whose debt is deemed unsustainable.

DDEP

Ghana applied the most aggressive debt restructuring which was first announced on December 5th, 2022. Arguably the first of its kind in the history of the country. The first phase of the Domestic Debt Exchange Programme was concluded in February 2023 following months of tough negotiations and conversations between the government and bondholders.

Some GH¢126.1 billion worth of outstanding domestic GOG bonds comprising fragmented holdings of bonds maturing each year from 2023 to 2034 and in 2039, were deemed eligible on a 1-for-1 basis under the program. GH¢8.4 billion and GHS 2.8 billion in ESLA (Energy Sector SPV) and Daakye (Education Funds SPV) bonds respectively, were also deemed eligible.

The Government restructured approximately GH¢83.0 billion in domestic debt principal from its originally proposed total and expects this to yield debt service savings of GH¢50 billion in 2023 but the program was later revised to include Cocoa bills, domestic debt denominated in U.S. dollars and the Bank of Ghana’s non-marketable securities including overdrafts (GH¢77.6 billion).

In the final and revised DDEP, the Government issuer of Treasury bonds (Daakye and ESLA) valued GH¢87 billion would saving approximately GH¢12.4 billion (14%) after the DDEP while making savings of GH¢7.2 billion on US$ Dominated local bonds valued US$742 million.

Savings

The government made saving GH¢4.5 billion (58.4%) on the Cocoa bills valued GH¢7.7 billion while the government made savings of GH¢37.6 billion (53%) on the Bank of Ghana’s marketable and non-marketable bonds valued GH¢70.9 billion.

On the Pension fund bonds valued GH¢29.6 billion the government made no savings (0%) on the DDEP because of their complete exemption from the programme. The government made total savings of GH¢61.7 billion on the government bonds valued GH¢203 billion.

Sovereign debt problems are probably as old as sovereign borrowing itself, with the first reported account dating in the fourth century B.C. in Greece (Sturzenegger and Zetelmeyer [2006] or Papaioannou, and Trebesch [2010] for a history of sovereign defaults). In more recent times, sovereign debt problems have often occurred in waves, including those in the 1970s and the 1990s that also affected Latin American countries. Given the many historical examples, there is a substantial literature that uses case studies to explore effects of debt restructurings or defaults on the macro-economy.

Even though generalisations can be difficult to draw, as the circumstances leading to the need of a debt operation are the result of unique factors and the developments afterward are often the result of external factors, some stylized facts have emerged (Papaioannou, and Trebesch [2010]. It has been shown that recessions are stronger and last longer for restructurings combined with foreign exchange and/or financial sector crisis.

The economic turbulence that leads to the debt problem often also leads to a real devaluation of the exchange rate, which can help in the subsequent recovery (e.g., Russia, Ukraine). Similarly, commodity-exporting countries often benefited from improved terms of trade in cases with a real devaluation.

Schmid (2016) noted that orderly restructurings, in which the debtor country negotiates settlement, are usually less costly for the economy than outright defaults. In both cases, the debtor country is excluded from international debt markets afterward, even though several countries have gained renewed access to external financing after only a short period. Cruces & Trebesch (2011) find that the cost of the restructuring for the creditors in terms of the haircut applied can also have an impact on the possibility to regain access to external financing.

Markets can be accessed again quickly in light restructurings. Finally, Papaioannou and Trebesch (2010) find out that debt restructurings create more disruption in countries with a substantial exposure of the domestic banking sector to government debt, with the restructurings often going hand in hand with a financial crisis, as experienced in Russia and Ecuador between 1998 and 2000.