GN Bank opts to become savings and loans company

The GN Bank is now a savings and loans company.

The Bank of Ghana announced this today at a press conference.

Related stories:

Heritage Bank collapsed, merged with Consolidated Bank

GN Bank downgraded to savings and loans company

Bank of Ghana appoints advisor for NIB

CLICK HERE TO DOWNLOAD FULL PRESS STATEMENT OF BOG ON THE BANKS

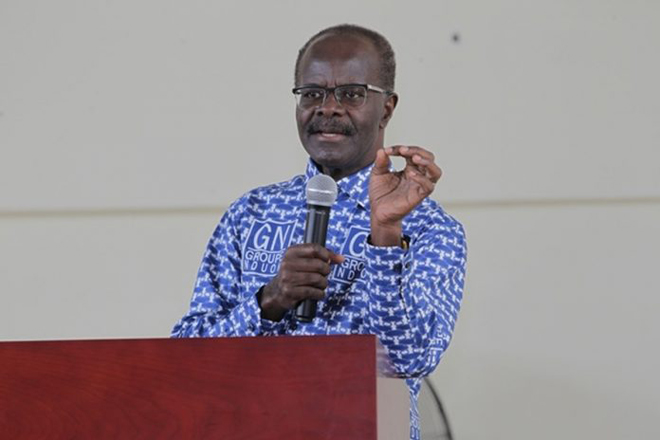

Watch the BoG's press conference below

GN has explained why it opted to become a savings and loans company.

Read the full press release issued by Frank Owusu-Ofori, Head, GN Corporate Affairs below

PRESS RELEASE ON GN BANK

“GN Bank Will Remain Ghanaian, With A National Retail Network, To Promote Financial Inclusion.”

The Shareholders, Directors

This means that our doors will remain open for business as usual in

This means that as a licensed

We operated in the recent past

It is necessary for us to also point out that in the process of looking for additional capital, we made a conscious decision not to sell our bank to mostly foreign interests.

These investors wanted the retail network we have built, but with the intention to abandon our vision of promoting financial inclusion and serving the needs of ordinary Ghanaians. We have been honest about who we are - a Main Street Bank and not a High Street Bank.

We formed the company and started looking for a license in 1997 to create a national bank for all Ghanaians wherever they may live, capable of ensuring financial inclusion and bringing the unbanked into the formal sector.

It took the founding shareholder, Coconut Grove Beach Resort, nine years and a lot of effort, to obtain a license from the Bank of Ghana on May 8,

Our financial institution has two intertwined branches - traditional banking and Micro-Enterprise business. The power of the two makes us unique and special. It took hard work to be where we are, with 1.2 million customers and 20% of the Ghanaian banking retail outlets in Ghana

We invested heavily in opening offices in all the ten regions of Ghana. When we opened our doors, the unbanked population was 80%. Today, it has fallen to 55%. Our continued existence will ensure that the percent of the population that is unbanked will reduce further.

From the very beginning, Our Vision has been, “To be a truly National Bank for the Ordinary person namely; Farmers, Professionals, Students, Workers, and Small and Medium Scale Entrepreneurs in Ghana.”

We will continue to be a financial institution with a difference - go where others are not willing to go, to bring banking to people currently excluded from the formal banking sector throughout the country.

Signed

Frank Owusu-Ofori

Head, GN Corporate Affairs