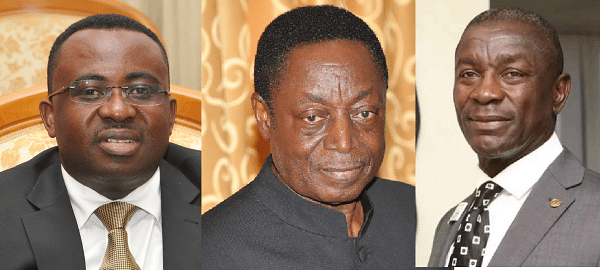

Duffuor, Asiama, Amoabeng, others hauled before court

The state has charged a former Finance Minister, Dr Kwabena Duffuor, and seven others with 68 counts for the roles they allegedly played in the collapse of uniBank.

The seven are Dr Kwabena Duffuor II, a son of Dr Duffuor, who was the Chief Executive Officer (CEO) of uniBank; Dr Johnson Pandit Asiama, a former Second Deputy Governor of the Bank of Ghana (BoG); Ekow Nyarko Dadzie-Dennis, the Chief Operating Officer of the bank; Elsie Dansoa Kyereh, the Executive Head of Corporate Banking; Jeffery Amon, a Senior Relationship Manager; Kwadwo Opoku Okoh, the Financial Control Manager, and Benjamin Ofori, the Executive Head of Credit Risk at the bank.

Also facing charges over the issue is the entity, HODA Holdings Limited, the majority shareholder of uniBank, which was said to be controlled by Dr Duffuor.

Specifics

The Attorney-General (A-G) has accused Dr Duffuor, who was a shareholder of uniBank, of contributing to the collapse of the bank by “dishonestly receiving” GH₵663.28 million from the bank.

Dr Asiama has also been named as an accused person on the charge sheet signed by the Director of Public Prosecutions (DPP), Mrs Yvonne Atakora Oboubisa, and filed at the Accra High Court.

It is the case of the A-G that even though uniBank was in financial distress, Dr Asiama allegedly used his position as the Second Deputy Governor of the BoG to approve the transfer of GH¢300 million, which was an unsecure credit facility from uniBank to the Universal Merchant Bank (UMB).

Dr Duffuor, who is also a former Governor of the BoG, has been charged with dishonestly receiving and money laundering, while Dr Asiama has been charged with wilfully causing financial loss to the state, in contravention of the Bank of Ghana Act, 2002 (Act 612).

Other charges levelled against the accused persons include fraudulent breach of trust, money laundering and conspiracy to commit crime.

Revocation of licence

UniBank was one of the five indigenous banks whose licences were revoked by the BoG in August 2018 after the central bank declared them insolvent.

The other banks were the BEIGE Bank, the Royal Bank, the Sovereign Bank and the Construction Bank.

After revoking the licences of the five banks, the BoG merged them into one entity known as the Consolidated Bank Ghana (CBG).

Prior to the revocation of the licences of the five banks, the BoG had already revoked the licences of two other indigenous banks — UT Bank and Capital Bank — in August 2017.

The BoG allowed the state-owned bank, GCB, to assume the reins of the two banks after taking over their assets in order to protect depositors’ funds.

The criminal case against Dr Duffuor, Dr Asiama and the executives of uniBank is part of a series of prosecutions against officials who were allegedly complicit in the banking crisis that hit the country from 2017.

Other people facing prosecution are William Ato Essien, the Founder of Capital Bank; Michael Nyinaku, the Founder and former CEO of the BEIGE Bank, and Prince Kofi Amoabeng, the Founder of the UT Bank.

Case against Duffuor and others

The statement of facts accompanying the charge sheet filed by the A-G stated that an audit by KPMG, the official administrator of uniBank after it went into receivership, revealed that the shareholders owed the bank about GH¢5.7 billion.

According to the A-G, between January 2014 and February 2018, Dr Duffuor and HODA Holdings Limited and its subsidiaries “dishonestly received” GH¢663.28 million, which were customers’ depositors, from the bank.

It is also the case of the A-G that at the instance of Dr Duffuor II and Dadzie-Dennis, uniBank “dishonestly” paid certain amounts, including GH¢35 million, to purchase some shares of the Ghana Oil Company (GOIL).

The said transaction, the A-G said, was made to benefit a related company of HODA Holdings.

“Between November 2015 and September 2017, at the instance of Dr Duffuor II (4th accused) and Dadzie-Dennis (5th accused), various dishonest payments of GH¢74 million were made by uniBank to fund a commercial printing and label manufacturing company, uniPrecision Printing and Packaging Company Limited, also a subsidiary of HODA. UniBank failed to recover these funds from uniPrecision,” the A-G said.

Also, the A-G said, uniBank applied for more than GH¢1 billion in liquidity support from the BoG between December 2015 and June 2016, but was able to pay back only GH¢150 million, leaving a deficit of GH¢850 million.

With regard to Dr Asiama, the A-G said he approved the transfer of funds from uniBank to UMB without following prescribed mandatory conditions.

According to the A-G, GH¢150 million of the GH¢300 million that Dr Asiama approved to be transferred from uniBank to UMB remained unpaid.

Amoabeng, others

Meanwhile, the Attorney-General (A-G) has filed fresh criminal charges against Prince Kofi Amoabeng, co-Founder of the defunct UT Bank, over the collapse of the bank.

A charge sheet containing Amoabeng’s alleged offences was filed at the Accra High Court yesterday, barely an hour after the state had decided not to prosecute him at the Accra Circuit Court.

The businessman has been charged with various counts of alleged fraudulent breaches of trust, deceit of a public officer and fabrication of evidence and fraudulently causing financial loss to the state.

It is the case of the A-G that Amoabeng “dishonestly appropriated “more than GH¢100 million of depositors’ funds that were invested in the defunct UT Bank.

Former BoG officials

Apart from Amoabeng, the A-G has also charged five others, including two former top officials of the Bank of Ghana (BoG), over the collapse of UT Bank.

They are Dr Johnson Pandit Asiama, a former Second Deputy Governor of the central bank, and Raymond Amanfu, a former Head of the Banking Supervision Department (BSD) of the BoG.

The two have been charged with wilfully causing financial loss to the state for allegedly approving GH¢460 million in liquidity support “without following prescribed mandatory conditions”.

“No payment was made for liquid support by the BoG,” the A-G stated in its facts accompanying the charge sheet.

Others

The other accused persons are Catherine Johnson, Head of Treasury of the UT Bank, and Robert Kwesi Armah, the General Manager of Corporate Banking of UT Bank and UT Holdings, the parent company of UT Bank.

In all, the A-G has charged the accused persons with 48 different counts of various offences of fraudulent breach of trust, deceit of a public officer and fabrication of evidence, fraudulently causing financial loss to the state and wilfully causing financial loss to the state.

Collapse of banks

The BoG collapsed the UT and the BEIGE banks by revoking their licences because the regulator said they were insolvent.

On August 14, 2017, the BoG revoked the licence of UT Bank and that of another indigenous bank, Capital Bank.

The BoG allowed the state-owned bank, GCB Bank, to assume the reins of both banks after taking over their assets in order to protect depositors’ funds.

The hurricane that swept through the banking industry due to the collapse of the two banks further heightened in August 2018 when the central bank collapsed five other indigenous banks for being insolvent and merged them into one entity, known as the Consolidated Bank Ghana (CBG).

The five banks were the BEIGE Bank, uniBank, The Royal Bank, the Sovereign Bank and the Construction Bank.