Headline inflation for July, which is due to be announced in mid-August, is expected to decline as the cedi remained relatively stable in July compared to June’s performance.

Total depreciation of the local currency against the dollar stood at 0.26 per cent in July as against June’s value of 1.80 per cent.

Already, the stability in the foreign exchange market has helped to prevent a potential price review of petroleum products in the month under review. This followed the rise in crude oil on the international commodities market on the back of consistent output cut by major producers including US, Saudi Arabia and Russia.

The period failed to witness a severe shock either from the domestic economy or from the external economy.

It, however, benefited from expectations of inflows from both the Swiss and Chinese governments.

On the back of the aforementioned, we foresee inflation to decline further to settle at 11.7±0.3 per cent at the next inflation announcement by the government’s statistician, which is scheduled for Wednesday, August 9.

{loadmodule mod_banners,Nativead1}

Treasury securities

The yield on the 91-Day T-Bill declined by 18 basis points (bs) to settle at 12.54 per cent. The rate of return on the 182-Day T-Bill also eased by five basis points to settle at 12.92 per cent.

The 1-Year note was, however, unchanged at 15 per cent.

A total of GH¢1.042 billion worth of bids were tendered, of which GH¢950.43 bids were accepted.

This fell marginally below the week’s target of GH¢991 million. The majority of the purchase, however, constituted the short-dated treasury securities as they accounted for 96.3 per cent of the total accepted bids. The government now expects to raise GH¢760 million from the 91-day and 182-day Treasury Securities and GH¢200 million from the 2-year fixed note on August 11.

{loadmodule mod_banners,Nativead1}

Equity market

The equity market closed bullish on the first trading week of the month. It registered its eighth consecutive week-on-week gains.

This draws from the continued digestion of half-year earnings report and money market rates.

The GSE Composite Index advanced by 0.49 per cent to settle at 2,268.45 points, representing a year-to-date return of 34.3 per cent.

The GSE Financial Index also upturned by 0.62 per cent to settle at 2,092.19 points, recording a year-to-date return of 35.38 per cent.

Twenty-four equities traded a total volume of 4.20 million shares valued at GH¢8.98 million.

This represents about 60 per cent increment over the previous week’s total traded volume.

Five equities, namely PBC Ltd, Guinness Ghana Brewery Ltd, CAL Bank Ltd, Societe Generale Ghana Ltd and Enterprise Ghana Ltd led the activity chart for the week’s trading; they accounted for 62.57 per cent of the total traded volume.

The market capitalisation also rose by 0.47 per cent to settle at GH¢57.49 billion.

Price movement

Nine stocks witnessed price movements at the close of the week’s trading.

On the list of advancers, Enterprise Group Ltd led the gainers. It added 21 pesewas to trade at GH¢2.67 per share.

Standard Chartered Bank Ltd and Ghana Oil Company Ltd had their share prices rising by three pesewas and two pesewas to trade at GH¢26.25 and GH¢2.31 per share respectively.

A pesewa gain was recorded in Fan Milk Ltd, Benso Oil Palm Plantation and Ecobank Transnational Incorporated. They settled at GH¢16.08, GH¢5.04 and 15 pesewas per share respectively.

Standard Chartered Bank Preference Share also ticked up by 16 pesewas to trade at GH¢1.20 per share.

On the flip side, Cal Bank Ltd shed two pesewas to close at 88 pesewas per share whereas Intravenous Infusion Ltd lost a pesewa to trade at eight pesewas per share.

Currency market

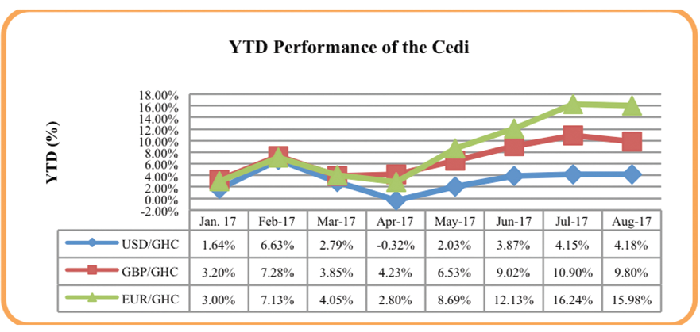

The week ended with the cedi advancing against the British pound but depreciated to both the US dollar and the Euro.

The British pound came on the defensive on the international forex market, following the rejection of the Bank of England to tighten its monetary policy for the first time in a decade.

The cedi, thus, appreciated by 0.54 per cent to trade at GH¢9.8 per pound, representing a year-to-date depreciation of 9.8 per cent.

The US dollar also slipped on the back of rising political turmoil, as the US investigates the supposed Russian interference in the US general elections.

The cedi traded at GH¢4.38 per dollar at a year-to-date depreciation of 4.18 per cent.

The Euro strengthened, as captivating economic data buoyed market sentiment.

The cedi lost by 0.13 per cent to trade at GH¢5.15 per euro, recording a year-to-date depreciation of 15.98 per cent. —IGS Financial Services Limited/GB