Cleaner diesel will cost more - GO Energy

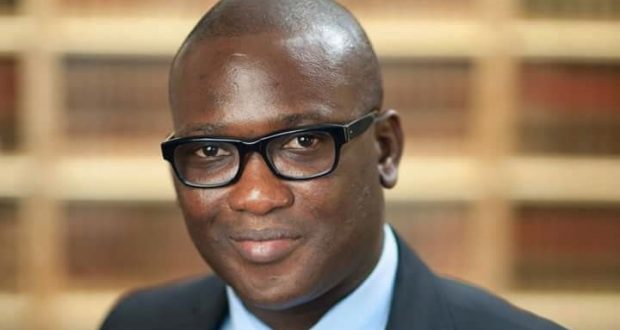

Ghana’s switch from diesels with high sulphur contents of 3,000 parts per million (PPM) to those with less sulphur concentration of 50PPM, effective August 1, can lead to increased ex-pump prices, GO Energy’s Chief Operating Officer (COO), Mr Gyamfi Amanquah, has said.

He said internal estimates by GO Energy, which is the market leader in the bulk oil supply business, showed that it will cost bulk oil distributors (BDCs) between US$10 to US$15 more to procure every ton of diesel with 50PMM compared to those with higher sulphur concentrations of 3000PPM.

The extra cost will arise from the variation in the pricing of the two fuel types, which are distinguished by their levels of sulphur concentrations.

Mr Amanquah told the GRAPHIC BUSINESS on August 1 that the increment at the pump could range between GHp4 per litre to GHp6 per litre, should oil marketing companies (OMCs) decide to pass-on the extra cost to consumers.

The conversion from US dollar to cedi is based on the current exchange rate of GH¢4.5 to a dollar.

“Some are saying that prices will not go up but that is not the picture; we subscribe to international pricing and when you compare the two, you realise that they are not the say,” he told the paper on August 1.

“If you have to reduce the sulphur, it means you have to work on it and that means premiums will go. That is how the price increase comes in,” he said.

As a result, Mr Amanquah said prices were bound to “go up unless the companies buy and decide to absorb the extra cost.”

He, however, explained that absorbing the price could defy international standards governing pricing.

{loadmodule mod_banners,Nativead1}

Bold step

Until the August 1 directive, Ghana was applying the West Africa specifications on diesel and gas oil importation, which required that 0.3 per cent of the fuel’s contents should be sulphur.

Thus, the switch to 50PMM fuels (0.05 per cent sulphur concentration) makes Ghana the first in West Africa to have taken such an initiative, seen as a great move towards saving the environment from the negative impact of high sulphuric fuels.

But unlike Ghana, most countries, including those in Europe, have used a gradual approach in switching from fuels with high sulphur concentrations to those with low sediments.

“To be frank, the history of this low sulphur all over the world has been different from what we want to practise. All of them started from high, like from 5,000PPM to 3,000PPM, 1,000PMM, 500PPM and then to 50PPM before 10PMM.”

“In our situation, we want to move from 3,000PPM to 50PPM,” he said in interview.

While this makes the situation “a bit difficult” for the stakeholders, Mr Amanquah observed that it represented a bold step that required innovation and a reorientation of the mindset of oil traders, BDCs’ and OMCs to succeed.

No more ‘mother vessel’

Currently, diesel volumes in West Africa are driven by Nigeria, where daily consumption averages 12 million litres compared to Ghana, where consumption is below one million litres per day.

As a result, bulk fuel traders in Ghana and their counterparts in the sub-region relied on a bigger vessel (known in the industry as ‘mother vessel’) that docks at Lome for their requirements.

The arrangement is such that the mother vessel brings the products in bulk for daughter vessels to cart away to their respective countries.

Given that Nigeria and neighbouring countries have not switched to 50PPM sulphur content diesels, Mr Amanquah said BDCs in the country would no longer rely on that ‘mother vessel’ in Lome for supplies.

Instead, they will have to procure directly from Europe, where 50PPM diesel and gas oil is produced

“So, if Nigeria too does not move to 50PPM, it can have some impact on us because we will have to buy straight from Europe”

“Now, if I am to buy from, let’s say Amsterdam, it will take a minimum of 10 days compared to the daughter vessels that take around two days. Now, what it means is that if you do not plan well, you can experience delays and that can lead to shortages,” he said.

Smart oil traders

On why the BDCs will not procure the consignment as a group and share, Mr Amanquah said the differences in their financial strength meant that pooling resources to trade could have adverse effects on the companies.

“We even had products with some other BDCs a few weeks back. We are financially sound but one or two of them were not. At the end of the day, there was demurrage. So, why do I have to continue with that, especially when the demurrages are very high,” he said.

He, however, explained that increased volumes of diesel in Ghana could motivate the “smart oil traders” to dedicate a ship to supply only 50PPM diesel to the companies.

Meanwhile, Mr Amanquah said GO Energy, which controls about 23 per cent of the market share, was well prepared to implement the NPA’s directive.