Depreciating cedi bane of importers

THE cost of imported goods will remain high as long as the local currency keeps depreciating. According to businesses, as forex rates continue their upward trajectory, businesses find themselves navigating increasingly harsh economic challenges.

While the maintenance of the policy rate offers a glimmer of stability in borrowing costs, concerns persist over the broader implications of currency volatility on inflation and monetary policy effectiveness.

Acknowledging the importance of policy rate consistency, businesses have stressed the urgent need for concerted efforts to stabilise the local currency.

In an interview with Graphic Business, the President of the Pharmaceutical Importers and Wholesalers Association (PIWA), Dr William Adum Addo, said the Bank of Ghana’s decision to maintain its monetary policy rate has left businesses disillusioned as high cost of borrowing persists amidst relentless currency depreciation.

“Despite hopes for relief, the Ghana cedi’s ongoing decline continues to burden businesses, worsening the already steep cost of operations in the country.

As businesses we cannot continue to shield ourselves from the impact of currency depreciation, we are left with no choice but to shift the burden onto consumers,” he said.

The President of the Ghana Union of Traders' Association (GUTA), Joseph Obeng, said “other indicators such as forex rates are going up and that is a difficult situation for businesses but the fact that the policy rate has been maintained will help with some stability with regards to the cost of borrowing which will also auger well for us.”

“However, our major issue here is the stabilisation of the local currency which needs a maximum attention in order not to throw away the gains we have made in the last couple of months.

If we don’t do anything about the high rate of the forex, it will trigger the inflation again and that will affect the monetary policy rate,” he added.

Policy rate unchanged

Last Monday, the Bank of Ghana (BoG) kept its monetary policy rate at 29% to further monitor developments in the economy.

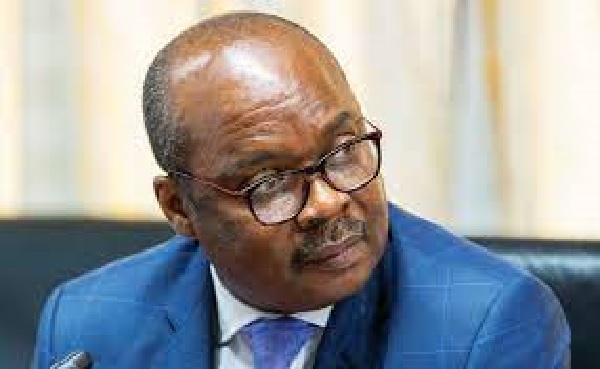

The Governor of the BoG, Dr Ernest Addison, said after decelerating sharply in 2023, the pace of disinflation has slowed in the first two months of the year.

He said although inflation rose slightly in January 2024 and edged down in February, the latest inflation forecast suggests a slightly elevated profile from the possible upward revision in transport fares, adjustment in utility tariffs, higher ex-pump prices, and some pass through of exchange rate depreciation.

"Overall, risks to inflation are slightly on the upside and will require close monitoring. Given these considerations, the Committee decided to maintain the Monetary Policy Rate at 29.0 percent," the Governor said.

Cedi’s performance in first quarter of 2024

The cedi is losing value to the major foreign trading currencies particularly, the United States Dollar, having shed about 6.8 per cent of its value in the first quarter of the year to date.

The Central Bank on March 28, 2024 sold one dollar for GH¢12.88 as against January 2, 2024 rate of GH¢11.88.

The Central Bank attributed the pressures on the cedi mainly from the strengthening of the US dollar on the international markets, and payments made to the energy and corporate sectors.

“These were compounded by delays and uncertainties associated with the second tranche of the cocoa loan inflow and World Bank’s disbursement of budget support,” Dr Addison added.

Assurance

At the last MPC meeting, Dr Addison was optimistic the Ghana cedi will remain relatively stable against the US dollar going forward due to strong reserves built by his outfit over the period.

“This is based some strong reserves that the Bank of Ghana has built over the past months to support the cedi, some fresh monetary measures being implemented, and strict enforcement of the foreign exchange regulations.

“We are now reporting reserves of more than $6.0 billion, and therefore the underlying factors that caused those pressures in the past have improved greatly,” he said.

He further said there had been improved remittance inflows and all these would support the currency in the coming months.

Development

The first tranche of the $300 million World Bank funds hit the accounts of the BoG last week.

The fund is expected to further boost the country’s foreign international reserves and help cushion the Cedi which has depreciated by 6.8 per cent since the beginning of the year.